Weekly Trader's Outlook

Stocks Experience Volatile Week on Higher Uncertainty

The Week That Was

If you read the last week's blog, you might recall that my forecast for this week was "Higher Volatility," citing heightened uncertainty due to last Friday's Supreme Court (SCOTUS) ruling on President Donald Trumps' tariffs, persistent artificial intelligence (AI) disruption concerns, several key earnings reports and an elevated CBOE Volatility Index (VIX). Stocks had a roller coaster week and the majors are on track to be down 0.50-0.80%. Once again, there has been a lot for markets to digest this week, so let me attempt to sum up the high-level takeaways for investors:

- U.S. trade representative Jamieson Greer said on Wednesday that tariffs will go from 10% to 15% on some countries and may go higher for others. Following the SCOTUS ruling on Friday, Trump's said he will levy a 10% global tariff under section 122 of the 1974 Trade Act.

- AI disruption concerns persisted this week but found some bid support following results from Salesforce and Snowflake on Wednesday. The iShares Expanded Tech-Software Sector ETF (IGV - $1.60 to $81.00) hit a new 52-week low on Tuesday ($76.26) but recovered throughout the week.

- Private credit concerns continued to weigh on investor sentiment this week, and the concerns broadened beyond exposure to software. Earlier today, a report in The Times said that Barclays may have exposure to potential losses following the collapse of Market Financial Solutions, a prominent player in the UK bridging and specialist lending market.

- The standout from this week's batch of economic data was this morning's hotter-than-expected Producer Price Index (PPI). The headline monthly gain of 0.8% was the biggest jump since July of 2025 and the +3.6% core year-over-year print is the highest reading since March of 2025. However, safe-haven buying sent U.S. Treasury yields lower this week, and yields on the 10-year dropped below the key 4.0% today.

- Q4 earnings scorecard: out of the 479 S&P 500 companies that have reported results, 66% have beat on the top line while 74% have beat on the bottom line. Revenue growth has been tracking at +9.60% year-over-year while earnings per share (EPS) growth is up to 14.64%.

Outlook for Next Week

At the time of this writing (1:15 p.m. ET) stocks are lower across the board, which appears to be driven by renewed private credit concerns and a reluctance by investors to hold exposure into the weekend given the uncertainty around Iran (DJI - 669, SPX - 54, $COMP - 277, RUT - 57). Earlier today, while President Trump said that a final decision on Iran hasn't been made, he stated, "I'd love not to use the U.S. military to attack Iran, but sometimes you have to." Geopolitics aside, investor sentiment is cautious–10-year Treasury yields are falling below 4.0%, private credit joins and AI disruption concerns loom, a solid "beat and raise" quarter from Nvidia was met with a sell-off and the VIX (+2.32 to 20.95) remains elevated. While the technicals didn't necessarily deteriorate this week, they didn't improve either and several indices remain just above support–the S&P 500 Index (SPX) is 0.30% above its 100-day Simple Moving Average (SMA) and the Russel 2000 (RUT) is currently trading a couple of points above its 50-day SMA. I don't mean to paint a dour backdrop for stocks, because the economy and earnings look healthy, but uncertainty is elevated and the near-term set-up for stocks looks challenging in my view. Therefore, I'm providing an overall "Slight to Moderate Bearish" forecast for next week. I don't expect a significant pullback, more of a bearish lean given the set-up heading into next week. What could challenge my forecast? If the SPX and RUT can hold above their respective support level, or if progress can be made on U.S./Iran negotiations, this could provide a near-term relief to investor sentiment, and perhaps a lift in stocks.

Other Potential Market-Moving Catalysts

Economic:

- Monday (Mar. 2): S&P Final U.S. Manufacturing Purchasing Managers' Index (PMI), ISM Manufacturing, Auto Sales

- Tuesday (Mar. 3): New York Federal Reserve President John Williams remarks, Minneapolis Fed President Neel Kashkari interview

- Wednesday (Mar. 4): ADP Employment report, S&P final U.S. Services PMI, ISM Services, Fed Beige Book, EIA Crude Oil Inventories

- Thursday (Mar. 5): Continuing Claims, EIA Natural Gas Inventories, Initial Claims, U.S. Productivity, Import Prices

- Friday (Mar. 6): Nonfarm Payrolls, Average Hourly Earnings, U.S. Unemployment Rate, Cleveland Fed President Beth Hammack speaks

Earnings:

- Monday (Mar. 2): AAON Inc. (AAON), ADT Inc. (ADT), AST SpaceMobile Inc. (ASTS), Credo Technology Group Holding Ltd. (CRDO), EchoStar Corporation (SATS), MongoDB Inc. (MDB), Norwegian Cruise Line Holdings Ltd. (NCLH), Venture Global Inc. (VG)

- Tuesday (Mar. 3): AeroVironment Inc. (AVAV), AutoZone Inc. (AZO), Best Buy Co. (BBY), CrowdStrike Holdings Ltd. (CRWD), GitLab Inc. (GTLB), QXO Inc. (QXO), Ross Stores Inc. (ROST), Sea Ltd. (SE), Target Corporation (TGT), Thor Industries Inc. (THO), Viking Holdings Ltd. (VIK)

- Wednesday (Mar. 4): Abercrombie & Fitch Co. (ANF), American Eagle Outfitters Inc. (AEO), Broadcom Inc. (AVGO), Brown-Forman Corporation (BF/A), Dycom Industries Inc. (DY), Ecopetrol S.A. (EC), Full Truck Alliance Co. (YMM), Okta Inc. (OKTA), Rigetti Computing Inc. (RGTI), Veeva Systems Inc. (VEEV)

- Thursday (Mar. 5): Alibaba Group Holding Ltd. (BABA), Burlington Stores Inc. (BURL), Canadian Natural Resources Ltd. (CNQ), Ciena Corp. (CIEN), Costco Wholesale Corp. (COST), JD.com Inc. (JD), Kroger Co. (KR), Marvell Technology Inc. (MRVL), Petroleo Brasileiro S.A. (PBR), Samsara Inc. (IOT)

- Friday (Mar. 6): Algonquin Power & Utilities Corp. (AQN), Embraer S.A. (EMBJ), Eve Holdings (EVEX), Genesco Inc. (GCO), Tsakos Energy Navigation Ltd. (TEN)

Economic Data, Rates & the Fed

There was a moderate dose of economic data for markets to digest this week, and the batch delivered some mixed signals. Probably the biggest surprise, and it wasn't a bullish surprise, was the hotter-than-expected wholesale inflation report (PPI). The headline monthly gain of 0.8% was the biggest jump since July of 2025 and the +3.6% core year-over-year (YoY) print is the highest reading since March of 2025. The increase in prices was driven by a 14.4% jump in professional/commercial equipment wholesaling margins. On the plus side, Chicago PMI jumped to a three-year high, Consumer Confidence showed some improvement and weekly Initial Claims remain subdued. Here's a breakdown of the reports:

- Producer Price Index (PPI): Headline month-over-month (MoM) wholesale prices increased 0.5% in January, up from +0.4% in December and above the +0.3% economists had expected. This translates into a YoY gain of 2.9%, a tick down from the 3.0% in the prior month but above the 2.6% expected.

- PPI Core – Core: Headline core wholesale prices increased 0.8% MoM (above the +0.3% expected) and +3.6% on a YoY basis, which was well above the 3.0% economists had expected.

- Consumer Confidence: Rose to 91.2 in February from January's revised reading of 89.0 and was above the 87.2 economists had expected. The strong reading was fueled by a 4.9-point jump (to 72.0) in the Expectations Index, which is forward looking measure of income, business and labor market conditions.

- Chicago PMI: Came in at 57.7, which was well above the 52.5 expected and the highest print since May of 2022.

- Construction Spending (December): +0.3% vs. +0.2% est.

- Factory Orders: -0.7% vs. +0.2% est.

- Wholesale Inventories: +0.2% vs. +0.2% est.

- Initial Jobless Claims: Initial applications for US jobless benefits rose by 4K from last week to 212K, which was below the 216K economists had expected. Continuing Claims declined 31K from the prior week to a seasonally adjusted 1.833M.

- EIA Crude Oil Inventories: +16M barrels.

- EIA Natural Gas Inventories: -24 bcf.

- The Atlanta Fed's GDPNow "nowcast" for Q1 GDP is unchanged vs. last week at 3.1%.

U.S. Treasury yields fell across the board this week, and the yield curve saw some flattening. This week's treasury buying may be a "flight to safety" move from investors, in part driven by private credit and AI disruption concerns, and uncertainty around U.S./Iran relations. Compared to last Friday, two-year Treasury yields dropped by ~7 basis points (3.404% vs. 3.48%), 10-year yields fell ~11 basis points (3.972% vs. 4.086%), while 30-year yields (4.633% vs. 4.725%) are lower by ~9 basis points.

Market expectations for rate cuts from the Fed in 2026 didn't shift much this week, remaining at relatively subdued levels. Per Bloomberg, the probability of a 25-basis-point cut from the Fed in March is unchanged at 5%, April ticked up to 20% from 18%, while June currently stands at 57% from 57% (all week-over-week).

Technical Take

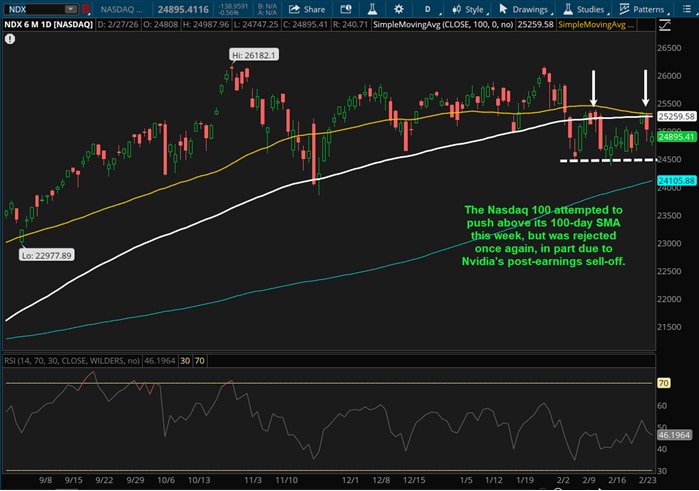

Nasdaq 100 Index (NDX - 138 to 24,895)

The Nasdaq 100 (NDX) is on track to be down 0.50% on the week, and it remains below its 100-day SMA, which has become near-term resistance. The index closed above the 100-day SMA on Wednesday, in anticipation of Nvidia's quarterly earnings, but subsequently followed Nvidia's post-earnings sell-off lower. This marks the second time the NDX was rejected at the 100-day SMA this month, so the price action is bearish in my view. Near-term support still appears to be ~24,500, and a close below this level could lend way to a test of support at the 200-day SMA (~24,105). This week's failed attempt to get back above the 100-day SMA, coupled with Nvidia's "sell on the news" post-earnings reaction, leads me to shift the near-term technical outlook on the NDX from "slightly bearish" to "moderately bearish."

Near-term technical translation: moderately bearish

Source: ThinkorSwim trading platform

Past performance is no guarantee of future results.

S&P 500 Index (SPX - 56 to 6,851)

The market-cap-weighted SPX is on track to be down 0.80% on the week, and the price action as choppy and sideways. The index remains confined within its ~6,800-7,00 two-month trading range. As I pointed out last week, the 100-day Simple Moving Average (SMA) has held up as support, but the multiple support tests at this indicator is not bullish behavior. The push-pull narrative in technology, that is AI disruption fears vs. healthy AI infrastructure investment, is likely contributing to the choppy sideways performance in the SPX. I'll stick with my "slightly bullish" perspective from last week (since the index continues to hold above the 100-day SMA), but admittedly, the trampoline bounces on near-term support is a bit concerning.

Near-term technical translation: slightly bullish

Source: ThinkorSwim trading platform

Past performance is no guarantee of future results.

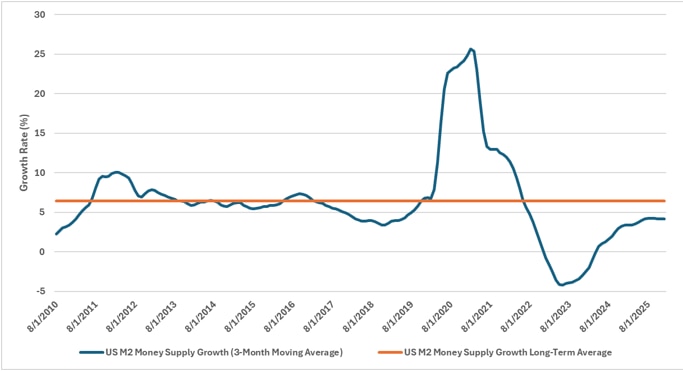

Cryptocurrency News

This week saw bitcoin rally following the State of the Union address, though it remains rangebound near its cost of production of ~$65,000 according to data from Glassnode. Investors have continued to debate bitcoin's status as a hedge against monetary debasement given the sharp rally in precious metals over the past few months. Putting that perspective in check, the U.S. budget deficit has actually improved relative to this point a year ago. As of December 31st, 2025, the deficit was 5.4% of gross domestic product (GDP), down from 6.9% of GDP on December 31st, 2024. At the same time, M2 Money Supply growth has been below its long-term growth rate of 6% and decelerating in recent months. While bitcoin has strongly underperformed other areas of the market over the past six months, its status as a hedge against monetary debasement may be supported.

Source: Bloomberg L.P.

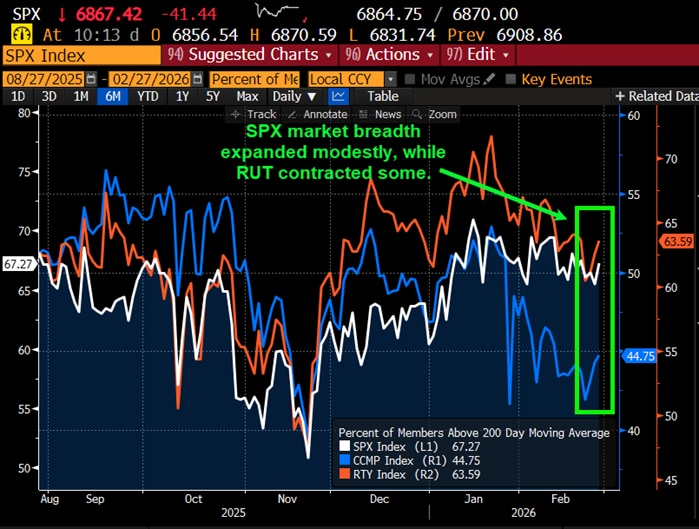

Market Breadth

The Bloomberg chart below shows the current percentage of members within the SPX, Nasdaq Composite (CCMP), amd Russell 2000 (RTY) that are trading above their respective 200-day SMAs. In short, stocks are on track to be modestly lower on a volatile week and market breadth saw some bifurcation. Market breadth on the SPX expanded while the RUT saw some contraction. Compared to last Friday's, the SPX (white line) breadth moved down to 67.27% from 64.08% and the CCMP (blue line) is essentially flat at 44.75% vs. 44.18%, while the RUT moved down to 63.59% from 66.67%.

Source: Bloomberg L.P.

Market breadth attempts to capture individual stock participation within an overall index, which can help convey underlying strength or weakness of a move or trend. Typically, broader participation suggests healthy investor sentiment and supportive technicals. There are many data points to help convey market breadth, such as advancing vs. declining issues, percentage of stocks within an index that are above or below a longer-term moving average, or new highs vs. new lows.

This Week's Notable 52-week Highs (97 today): Albemarle Corp. (ALB - $1.85 to $183.08), Bloom Energy Corp. (BE - $5.07 to $163.50), Ciena Corp. (CIEN + $7.44 to $348.60), GE Vernova Inc. (GEV - $16.07 to $860.39), Lumentum Holdings Inc. (LITE + $10.44 to $687.44), Teradyne Inc. (TER - $16.67 to $316.02)

This Week's Notable 52-week Lows (43 today): DocuSign Inc. (DOCU - $1.48 to $44.24), EPAM Systems Inc. (EPAM - $3.02 to $135.60), GoDaddy Inc. (GDDY - $3.42 to $82.78), Pool Corp. (POOL - $0.66 to $222.65), Workday Inc. (WDAY - $7.40 to $131.70), Wix.com Ltd. (WIX - $1.67 to $69.64)