Options Strategy Spotlight: Long Call vs. Bull Call Spread

Among those who trade long options, most are likely familiar with one of the biggest drawbacks of this strategy, which is the impact of time decay. Once a trader purchases a long call or put, they can expect their option to lose a little bit of value every day until expiration, all other things being equal. An estimate of how much might be lost is expressed in the "greek" measure known as theta.

One way a trader can help offset the impact of time decay on a long option is by simultaneously selling another option against their initial position to form what is known as an options spread. There are other benefits that spreads can offer, but like all options strategies, there are also some trade-offs. In this article, we'll compare a long call with a vertical bull call spread in order to help illustrate some benefits and risks.

Spread trading is considered an intermediate options strategy and requires options approval level 2 at Charles Schwab.

For more information on long calls and bullish spreads, visit Understanding Options on Schwab.com.

Strategy comparison using an example

Let's assume there are two traders who are equally bullish on stock symbol ZXY in the near term and intend to use options to potentially capitalize on that bullish forecast.

Trader #1 decides to purchase a long call, while Trader #2 decides to establish a bull call spread.

Let's start by evaluating Trader #1's long call strategy using some common strategy attributes and options greeks, such as delta, theta, and vega. Then we'll perform the same assessment on Trader #2's bull call spread. Finally, we'll put these two strategies side by side and review their respective benefits and trade-offs.

Long call example

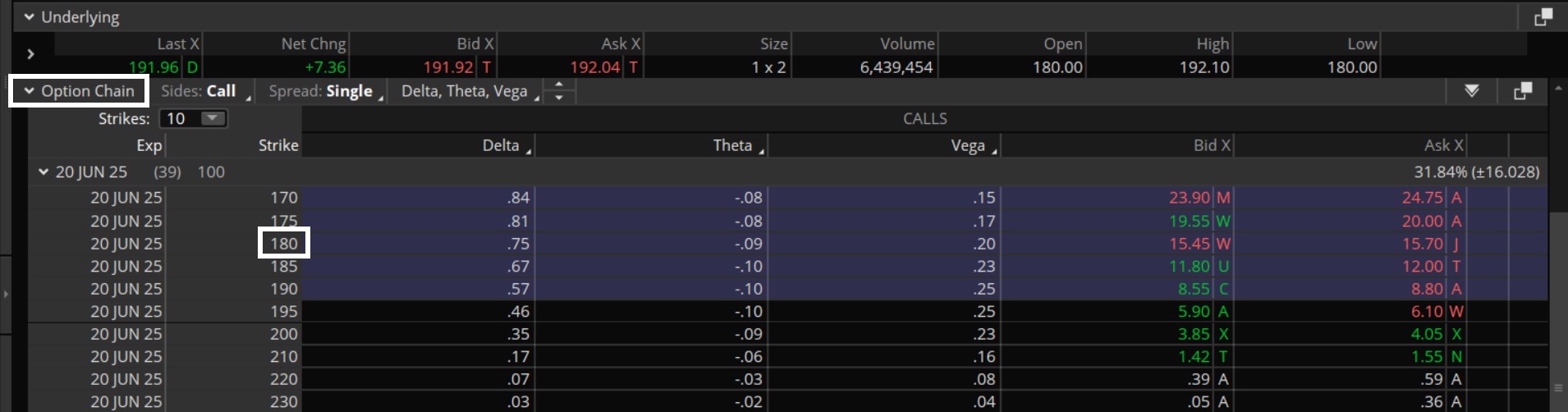

To start, let's assume that ZXY is trading for $191.96, and Trader #1 decides to purchase the 180.00 call that expires in 39 days. With the help of some greeks from the option chain below, let's assess what this implies about this particular contract.

Source: thinkorswim® platform

ZXY 5/20/2025 180.00 C Summary

| Cost | Break-Even Price | Delta | Theta | Vega | Maximum Gain | |

|---|---|---|---|---|---|---|

| 180.00 Call | $1,570 | $195.70 | 0.75 | –0.09 | 0.20 | Unlimited |

- Cost: As we can see from the image above, the 180.00 call has an ask price of $15.70, so the total cost, taking the 100 multiplier into account, is $1,570, excluding commissions. The cost (as with any long options strategy) is also the maximum potential loss.

- Break-even price: The break-even price is calculated by adding the cost of the 180.00 call to the strike price, so 180.00 + $15.70 yields a break-even price of $195.70. By purchasing this call, Trader #1 is essentially indicating that they believe ZXY will close above the break-even price of $195.70 at expiration (let's assume this trader does not intend to close out the position prior to expiration).

- Delta: The 0.75 delta has two implications—this particular call has an approximate 75% chance of closing in the money at expiration, and initially one can expect the value of this contract to increase/decrease by about $0.75 for a corresponding $1 move higher/lower (respectively) in the price of ZXY. Delta is a dynamic number that changes when any of the other options pricing variables change.

- Theta: A theta of –0.09 suggests that, initially, the value of this contract is expected to lose roughly $0.09 per day, all other variables held constant. Like delta, and all the greeks for that matter, theta is also a dynamic number that changes when any of the options pricing variables change.

- Vega: A vega of 0.20 tells the trader how much they can initially expect the value of the contract to change in reaction to a 1% change in the implied volatility of ZXY. For example, if the implied volatility on ZXY decreases 1%, the trader can expect the value of this contract to initially lose $0.20.

- Maximum gain: Similar to a long stock position, the price of ZXY really doesn't have a theoretical limit to how high it can rise and therefore neither does the long call (at least up until expiration).

Bull call spread example

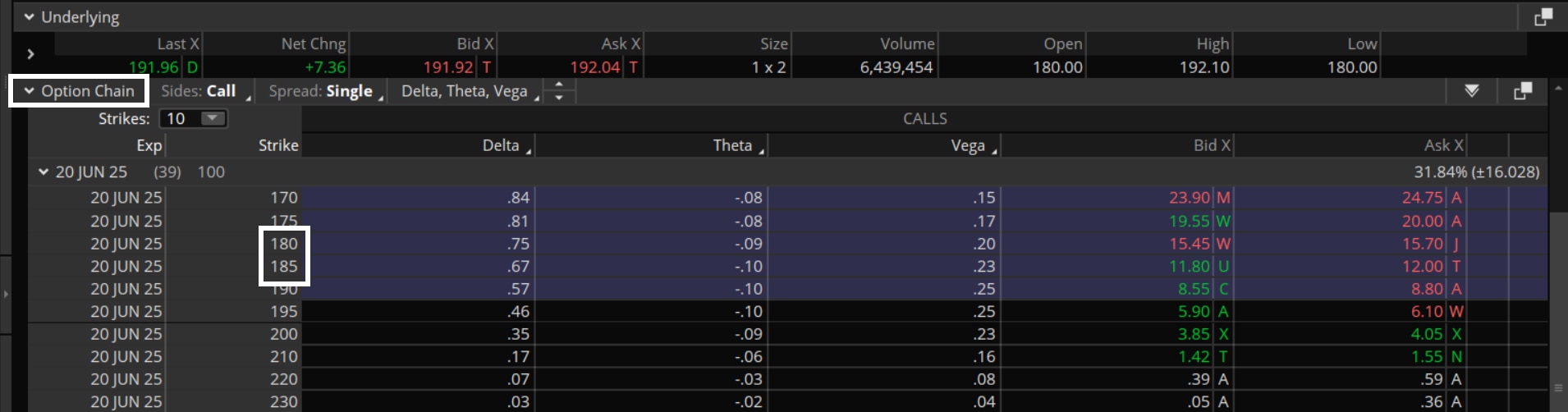

Now let's turn to Trader #2 who also decides to buy the 180.00 call, which expires in 39 days, but also decides to simultaneously sell the 185.00 call, which expires at the same time, thereby establishing a 180.00/185.00 vertical bull call spread.

Source: thinkorswim platform

ZXY 5/20/2025 180.00 C/185.00 C Summary

| Cost | Break-Even Price | Delta | Theta | Vega | Maximum Gain | |

|---|---|---|---|---|---|---|

| 180.00 Call | $1,570 | $195.70 | 0.75 | –0.09 | 0.20 | Unlimited |

| 185.00 Call | –$1,180 |

$196.80 |

–0.67 | +0.10 | –0.03 | $1,180 |

| Combined Spread | $390 | $183.90 | 0.08 | 0.01 | –0.03 | $110.00 |

- Cost: As we previously established, the cost of the 180.00 call is $15.70, so when taking into account the $11.80 received from selling the 185.00 call, the total cost of the spread is $3.90, or $390, when taking the 100 multiplier into account (excluding commissions). The $390 cost of this spread represents the maximum potential loss and occurs if ZXY closes at or below $180 at expiration.

- Break-even price: The break-even price for this spread is calculated by adding the $3.90 combined cost of the spread to the lower strike price of 180.00, which gives us a price of $183.90 at expiration.

- Delta: The combined delta for this bull call spread is calculated by subtracting the 0.67 delta of the 185.00 call from the 0.75 delta of the 180.00 call. The delta of the 185.00 call is subtracted from the 180.00 call because the contract is being sold and the combined spread delta of 0.08 (0.75 – 0.67) indicates the value of the overall spread will initially increase or decrease by about $0.08 with a corresponding $1 move (higher or lower) in the price of ZXY.

- Theta: Because the 185.00 call is being sold, theta is positive (a short call gains value with the passage of time, all else held constant). Similar to delta, this 0.10 theta is then combined with the –0.09 theta of the 180.00 call, which gives us a positive 0.01 theta for the overall spread. While this suggests the value of the spread will initially gain a little bit of value with the passage of time, keep in mind, the theta of each contract is subject to change with the passage of time, or when any of the options pricing variables are altered.

- Vega: Similar to delta and theta, vega of 0.20 on the 180.00 call is combined with the negative vega of the short 185.00 call, which gives us a net vega of –0.03 for the combined spread. This low vega suggests volatility risk has essentially been taken out of the equation. If implied volatility rises or falls significantly, the gain or loss from the long contract (i.e., the 180.00 call) is nearly completely offset by the corresponding gain or loss from the short contract (i.e., the 185.00 call).

- Maximum gain: The maximum gain of this bull call spread equals the distance between the two strikes, or $5, minus the cost of the combined spread ($3.90). Therefore, the maximum gain is $5 – $3.90 = $1.10, or $110 when taking the 100 multiplier into consideration (excluding commissions). The maximum gain is achieved if ZXY closes at or above $185 at expiration.

Now let's compare these two strategies to get a better sense of their respective benefits and drawbacks.

Long call vs. bull call spread

| Cost | Break-Even Price | Delta | Theta | Vega | Maximum Gain | |

|---|---|---|---|---|---|---|

| 180.00 Call | $1,570 | $195.70 | 0.75 | –.09 | 0.20 | Unlimited |

| 180.00/185.00 Call Spread | $390 | $183.90 | 0.08 | 0.01 | –0.03 | $110.0 |

- Cost: Lower overall cost is a primary driver of establishing a debit spread, and the bull call spread in this example costs about 75% less than the long call spread. Advantage: bull call spread.

- Break-even price: In order for the long call to break even, the price of the underlying needs to increase by $3.74 ($195.70 – $191.96) in 39 days. Conversely, at a current price of $191.96, ZXY can go entirely sideways for the next 39 days and the bull call spread will still manage a maximum gain because the break-even price is $183.90, and max gain is achieved above $185 at expiration. Additionally, if the trader thinks of a trade strictly in terms of the "probability of making a profit" and considers all the possible ZXY closing prices at expiration, then the nod goes to the 180.00/185.00 bull call spread in this category. Advantage: bull call spread.

- Delta: The disparity between the deltas of these two strategies highlights one of the biggest drawbacks of a spread trade: lower relative gain with a beneficial move in the price of the underlying. Both traders are bullish on ZXY, but Trader #1 will see the value of their long call increase by about $0.75 with a $1 increase in ZXY, while Trader #2 will only see an increase of about $0.08. As expiration approaches, the combined delta on the spread is likely to move closer to parity with the 180.00 call, but bull call spread traders need to be aware of this trade-off: The increase in value from the long option is going to be partially offset by the increase in value from the short option when one gets a beneficial move in the price of the underlying. Advantage: long call.

- Theta: Time decay can be one of the biggest profit eliminators for long option traders, and as you can see in the table above, the 180.00 long call is initially set to lose approximately $0.09, or about 0.6%, per day due to time decay. Conversely, you can see that not only has time decay been eliminated on the 180.00/185.00 bull call spread, but there would actually be an initial (albeit small) gain after one day elapses (all other variables held constant). Advantage: bull call spread.

- Vega: The value of the 180.00 long call stands to gain $0.20 with a 1% increase in implied volatility but lose $0.20 with a 1% drop in implied volatility. Therefore, you can see that there is "volatility risk" to the long call strategy. However, with a vega of just –0.03, the 180.00/185.00 bull call spread has essentially eliminated volatility risk. Some might consider taking the volatility risk out of the equation a benefit of spread trading, but because the benefit is not necessarily clear-cut, we'll mark this category as neutral. No advantage to either long call or bull call spread.

- Maximum gain: The potential for significant profits is probably one of the most alluring factors for long option traders. As you can see from above, the 180.00 long call offers (theoretical) unlimited upside, while the 180.00/185.00 bull call spread can only achieve a $110 profit at best. The maximum gain of $110 profit on the bull call spread represents a 28% profit potential when compared to the $390 cost (excluding commissions). Advantage: long call.

Bottom line

The intent of this article is not to persuade a prospective trader to select one strategy over another; rather, it's meant to help shed light on the benefits and trade-offs to assist traders when deciding which strategy to initiate. If a trader is comfortable with the risk and is exceptionally bullish on a stock, then they might prefer a long call strategy over a bull call spread because it offers more profit potential.

Having said that, even if a trader is bullish on a stock, the stock may not make the desired move within the needed time frame in order to achieve a profit, so the trader might consider a bull call spread because it substantially reduces the time decay component. Regardless of how a trader elects to proceed, this article should have provided some insight into how these two strategies match up.