Europe's Economic Future: A Bright Spot?

Growth in Europe may be slowing in the near term, but the longer-term outlook is still improving, driven by accommodative monetary policy and increased fiscal spending in Germany. Private companies in Germany are joining the investment drive, according to news reports, which could stimulate growth. We believe European stocks deserve a spot in investors' portfolios due to the combination of attractive valuations and improving growth.

Near-term slowdown

The eurozone economy grew a modest 0.4% quarter-over-quarter annualized in the second quarter, according to Eurostat, the statistical office of the European Union. The slowdown from the 2.4% reading in the first quarter suggests that the acceleration of exports to the U.S.—an attempt to get ahead of tariffs announced by President Donald Trump earlier this year—that boosted gross domestic product (GDP) growth in the first quarter likely has ended. The eurozone economy likely could weaken further in the near term, an outlook suggested by German factory orders falling for a second month in June (according to German statistics agency Destatis) and by lower outlooks from carmakers including Volkswagen, Mercedes-Benz and others.

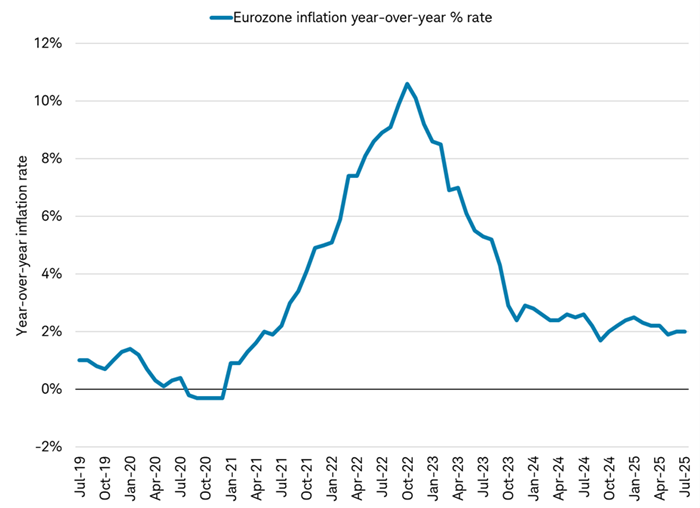

Despite the near-term slowing, the outlook for the future remains brighter. European consumers are benefitting from the lowest unemployment in 25 years, according to Eurostat, and by a stabilization in inflation. The gain in the value of the euro this year also has boosted purchasing power, putting downward pressure on import prices. The European Central Bank's (ECB) wage tracker forecasts wage growth of around 3%, which is consistent with the ECB's longer-term inflation target of 2% plus a 1% increase in productivity growth. This suggests inflation is not projected to heat up. There may even be downward pressure on prices should goods initially destined for the U.S. from China be redirected to the eurozone, increasing supply.

Eurozone unemployment is at a record low

Source: Charles Schwab, Bloomberg, as of 8/8/2025.

The eurozone is a currency union of member states of the European Union that have adopted the euro as their primary currency. The 20 eurozone members are: Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain.

Eurozone inflation is stabilizing

Source: Charles Schwab, Bloomberg, as of 8/8/2025.

The J.P. Morgan Global Manufacturing Purchasing Manager Index (PMI) has fallen in four of the last seven months year to date, but in the same period the Eurozone Manufacturing PMI has been resilient, increasing every month so far this year. Components of the PMI that are providing lift include new export orders improving to expansion territory in June for the first time in over three years and an unchanged rate of job cuts. For the individual countries making up the region, the July manufacturing PMI improved in Germany, Italy, Spain, the Netherlands and Austria. The Organization for Economic Co-operation and Development (OECD) leading indicator for Europe's four largest economies (Germany, France, the U.K. and Italy) has risen for a record 32 consecutive months through June).

Germany is driving future optimism

Economic optimism is led by businesses in the largest European country, Germany. German companies' sentiment is measured by the Ifo Business Climate Index, which rose to 88.6 index points in July, continuing the string of monthly increases seen year to date. The future expectations component has reached a level last seen two years ago. Within the report, both the current situation and future expectations components for the manufacturing and construction sectors increased, despite the new orders component lacking momentum.

German business optimism has risen

Source: Charles Schwab, FactSet as of 8/7/2025. Index value is normalized to the base year of 2015 (2015=100).

This year's fiscal budget for Germany, passed at the end of June, suggests the second half of 2025 may see an increase in government spending, particularly for defense. New construction on infrastructure might pick up starting in 2026. This spending is part of legislation passed earlier this year for multi-year spending on defense and infrastructure that allocates 1 trillion euros over the next 10 years and potentially boosts economic growth by 1.5% a year for the next decade, possibly providing a new growth story in Europe.

Investments by businesses set to grow

Optimism about the future has influenced private businesses to join the investment drive. More than 60 of Germany's companies are coordinating with German Chancellor Friedrich Merz to announce 631 billion euros ($738 billion) of new projects over the next three years as part of the "Made for Germany" initiative, according to news reports. The money will go to both new and existing factories, as well as research and development.

Germany's government recently announced that it aims to encourage additional private spending through a 100 billion euro ($117 billion) investment fund, the Germany Fund (Deutschlandfonds). The fund initially will be backed with at least 10 billion euros in public money and will aim to mobilize 10 times that amount in private capital, according to a statement from the Ministry of Economy to Bloomberg published on August 6th. The goal is to attract investment in strategic sectors such as defense, energy infrastructure and critical raw materials. The official launch would likely take place in September or October, following the parliament's summer recess, according to sources close to the plan.

Additional support for Germany's economic growth would include a reduction in bureaucracy and pledges by the ruling coalition to undertake reforms to the labor and employment frameworks. In speeches, Merz has made it clear that reforming the social system is first on his agenda, which could help further reduce the cost of labor and improve business sentiment.

Investment implications

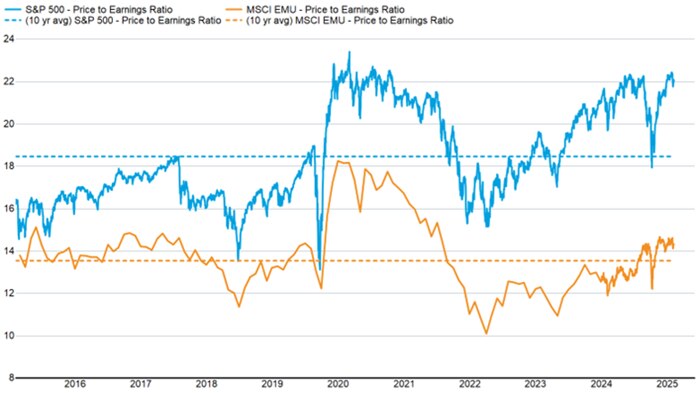

We believe stocks of European companies belong in a diversified portfolio due to the potential for an acceleration in longer-term growth as well as attractive valuations. The MSCI European Economic and Monetary Union (EMU) Index was trading at 14.4 times next-12-months earnings as of August 5th, significantly below the 22.2 times for the S&P 500 index. Additionally, any resumption of dollar weakness—perhaps as expectations grow that Federal Reserve policymakers will cut interest rates, while the ECB may have ended its cutting cycle—potentially would add to international stock returns. A stronger euro relative to the U.S. dollar means returns denominated in euros exchange into more dollars, which boosts returns for U.S. investors.

European stocks currently trade at significant discount to U.S. stocks

Source: Charles Schwab, FactSet, as of 8/7/2025.

Past performance is no guarantee of future results.

Stocks in economically sensitive, or "cyclical," sectors such as Financials and Industrials are outperforming in Europe, a situation that usually occurs when investors believe growth is going to improve. These are the two largest sectors in the MSCI EMU Index, at 24% and 21%, respectively. So far during this second-quarter earnings season, the Financials sector has seen the largest number of upward earnings revisions within the STOXX Europe 600 index, according to the London Stock Exchange Group Institutional Brokers' Estimate System (LSEG I/B/E/S).

Heather O'Leary, Senior Global Investment Research Analyst, contributed to this report.