Schwab Market Update

Trade Hopes, Chip News Lift Stocks After Fed Pause

Published as of: May 8, 2025, 9:10 a.m. ET

Listen to this article

Listen here or subscribe for free to the Schwab Market Update in your favorite podcast app.

| The markets | Last price | Change | % change |

|---|---|---|---|

| S&P 500® index |

5,631.28 |

+24.37 |

+0.43% |

| Dow Jones Industrial Average® |

41,113.97 |

+284.97 |

+0.70% |

| Nasdaq Composite® |

17,738.16 |

+48.50 |

+0.27% |

| 10-year Treasury yield |

4.30% |

+0.03 |

-- |

| U.S. Dollar Index |

99.94 |

+0.32 |

+0.32% |

| Cboe Volatility Index® |

23.01 |

-0.54 |

-2.29% |

| WTI Crude Oil |

$59.18 |

+$1.11 |

+1.88% |

| Bitcoin |

$99,346.43 |

+3,137.59 |

+3.26% |

(Thursday market open) The Federal Reserve meeting already seems long ago after it kept rates paused and Chairman Jerome Powell called for patience amid uncertain tariff policy. Instead, Wall Street is focused on chip stocks and trade agreements after President Trump hinted at a major trade deal and suggested he could lift certain restrictions on chip exports that hurt companies like Nvidia (NVDA).

Though that affects many countries, it also seems to warm the atmosphere ahead of weekend talks between the U.S. and China. There appears to be progress elsewhere, too, as Trump announced a trade agreement with a major country that The Wall Street Journal reported is the U.K. Stocks rose on the news, and "risk-on" sentiment reappeared in the crypto market and Magnificent Seven stocks. However, with roughly 60 days left before Trump's 90-day tariff extension ends and dozens of negotiations remaining, the "liberation day" scenario hasn't vanished and the uncertainty Powell cited is far from over.

"The big sticking point preventing the Fed from easing policy is lack of clarity around trade policy," said Kathy Jones, chief fixed income strategist at Schwab. "With the potential for tariffs to raise prices, the Fed's concern is that a temporary rise in inflation would become more persistent. Since the size and breadth of tariffs is still in flux, the Fed can't estimate what the impact will be on the economy."

To get the Schwab Market Update in your inbox every morning, subscribe on Schwab.com.

Three things to watch

- Claims and productivity fall, labor costs rise: initial weekly jobless claims of 228,000 fell from 241,000 the prior week and came in below the Briefing.com consensus. That was the good news after last week's slight bump raised concerns. "Jobless claims are in line with the recent trend," Schwab's Jones said. "Continuing claims have been steadily rising, however." The not so good news was first quarter productivity front, where the headline fell 0.8% after a 1.7% rise in the fourth quarter. Unit labor costs also soared 5.7% in the first quarter versus the consensus of 4%. Higher labor costs and lower productivity suggest companies aren't getting as much work done per worker and are paying more to do it—not good for profitability. "Productivity fell for the first time in nearly three years, but measuring productivity is difficult and quarter-over-quarter there can be distortions," said Cooper Howard, director, fixed income strategy, at the Schwab Center for Financial Research. "The market's not putting too much weight into this report."

- Stock buybacks soar to more than $600 billion: Heading into earnings season, one thing that seemed likely was more buybacks as companies took advantage of lower stock prices. The predictions came true, as the value of U.S. stock buybacks reached more than $600 billion year to date. That's above the prior high of $598.5 billion through this point in 2022, according to Birinyi Associates, Bloomberg reported. They were $233.8 billion in April alone. Buying back stocks returns money to shareholders, helping them in turbulent times for the market and the economy. But it can also send signals that companies have little better to do with their money. Some investors might prefer companies invest in research and development. While that's a potential drawback, buybacks often lift shares of the company executing the transaction, reinforcing ideas that the companies see their own shares as a good investment. Some of the biggest firms announcing buybacks recently include Apple (AAPL), Visa (V), Wells Fargo (WFC), and 3M (MMM), Bloomberg noted.

- "Fed day" trading goes against pattern: The hours after Fed announcements often see markets swoon, at least for the last few Fed meetings before yesterday's. This could reflect not just the rate decisions, but what Powell says in his press conferences. Yesterday appeared to follow that pattern for the first half of the press conference as the S&P 500 index (SPX) initially fell after the Fed's statement triggered worries of stagflation (inflation and slower growth). Stocks gradually clawed back as Powell spoke of rates being well positioned for either higher inflation or rising unemployment, and of the economy being in a good place. Then the market surged in the final minutes on the semiconductor chip headlines, which had nothing to do with the Fed and everything to do with trade. Speaking of which, Powell seems as uncertain about tariffs as everyone else. "Weakening economic activity could translate into higher unemployment, or we could see higher inflation," he said. "It's really not at all clear what we should do." Schwab's Jones expects long-term rates to not decline as much as short-term rates amid concerns over inflation, rising budget deficits and the appetite of foreign investors for U.S. Treasuries. Yields rose this morning across the curve and a 30-year bond auction is scheduled later.

On the move

- Nvidia jumped 1.4% on hopes of lighter chip export restrictions. Earlier this year, it publicly opposed restrictions imposed by the Biden administration, and those specific ones could either be revamped or thrown out, judging from the Trump announcement. Last month Nvidia announced it was taking a $5.5 billion charge due to new licensing requirements on exports of a less-advanced chip to China, but that restriction doesn't appear to be going away.

- Alphabet (GOOGL) rebounded 2% ahead of the open after falling more than 7% yesterday as Bloomberg reported that Apple is considering reworking the Safari web browser on its devices to focus on AI-powered search engines. Google has long been the default search tool of Apple's browser, but a court case could force the two to unwind the pact.

- Health care stocks including Eli Lilly (LLY), AbbVie (ABBV), Merck (MRK), and others were down 1% or more in pre-market trading on news that the Trump administration aims to lower drug costs by tying prices in the Medicaid program to prices foreign countries pay, Bloomberg reported. The pharma industry says this could cost drug firms as much as $1 trillion over a decade.

- Arm Holdings (ARM) plunged 8% after the British chip designer delivered a forecast that disappointed investors amid worries tariffs could hurt revenue. Revenue and earnings surpassed consensus views.

- AppLovin (APP) jumped 13% in pre-market action after the advertising tech technology company posted better-than-expected quarterly results as ad revenue growth surged. AppLovin also is selling its mobile gaming business.

- Crypto-related stocks Coinbase (COIN) and MicroStrategy (MSTR) were up 4% to 5% ahead of the open as cryptocurrencies gained amid improved market sentiment. Most major cryptocurrencies were up 3% or more early Thursday. In other news, The Wall Street Journal reported that Coinbase—which reports later today—plans to acquire crypto derivatives exchange Deribit for $2.9 billion.

- Shopify (SHOP) plunged 8% as the company's outlook for quarterly sales came in about as analysts had expected and gross merchandise volume in the last quarter slightly missed expectations. Tariff fears are hurting the stock.

- Fortinet (FTNT), a cybersecurity firm, saw shares tumble 8% ahead of the open. Earnings beat Wall Street's estimates but the revenue forecast appeared to disappoint.

- Carvana (CVNA) jumped nearly 5% after beating analysts' earnings outlook as profits nearly doubled.

More insights from Schwab

Fed cuts expected in September: The longer-term outlook is for lower interest rates. "We continue to expect the Fed to cut the federal funds rate later in the year, most likely starting at the September meeting," said Schwab's Jones in her Fed meeting analysis. "Our outlook is for two rate cuts, but a sharper drop is possible if the economy slips into recession."

" id="body_disclosure--media_disclosure--89106" >Fed cuts expected in September: The longer-term outlook is for lower interest rates. "We continue to expect the Fed to cut the federal funds rate later in the year, most likely starting at the September meeting," said Schwab's Jones in her Fed meeting analysis. "Our outlook is for two rate cuts, but a sharper drop is possible if the economy slips into recession."

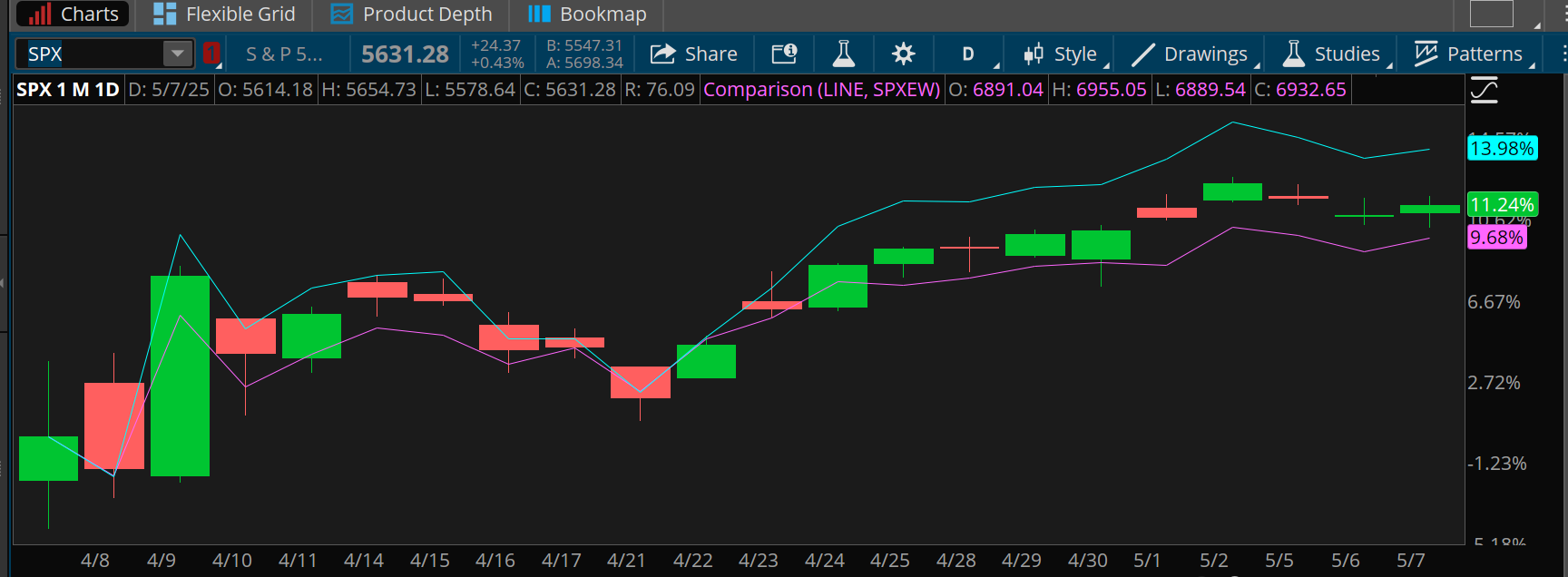

Chart of the day

Data sources: Nasdaq, S&P Dow Jones Indices. Chart source: thinkorswim® platform.

Past performance is no guarantee of future results.

For illustrative purposes only.

The S&P 500 index (SPX—candlesticks) has pulled into a lead over the S&P 500 Equal Weight Index (SPXEW—purple line) over the last month but still trails it for the year. This reflects the path of mega caps and their huge impact on the SPX, which is muted in the SPXEW as that index weighs all stocks equally. Strength in the mega caps over the last month, reflected in the outperformance of the Nasdaq-100® (NDX-blue line), also pulled up the SPX. Earlier this year, weakness in mega caps kept the SPX weak while the SPXEW suffered lighter losses as other sectors beyond tech picked up some of the slack.

The week ahead

Check out the Investors' Calendar for a summary of the top economic events and earnings reports on tap this week.

May 9: Expected earnings from Enbridge (ENB).

May 12: Expected earnings from Hertz (HTZ).

May 13: April CPI and core CPI and expected earnings from JD.com (JD) and Under Armour (UAA).

May 14: Expected earnings from Cisco (CSCO).

May 15: April PPI and core PPI, April industrial production, April retail sales, and expected earnings from Alibaba (BABA), Walmart (WMT), Deere (DE), Applied Materials (AMAT), and Cava Group (CAVA).