Scar Tissue: Weak Jobs Report Emphasizes COVID’s Scars

Key Points

December’s payroll report was weaker-than-expected; but not without some bright spots.

Small business trends bear watching—notably hiring plans as well as most significant constraints on hiring.

Economic “scarring” from the pandemic is likely to be significant—in the labor market, but also in terms of “belief changes.”

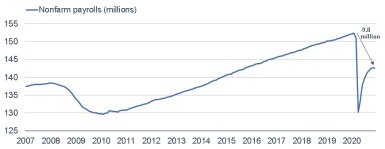

Last week was shocking and extraordinarily sad; and as if Americans didn’t have enough with which to contend, it was capped off by a weaker-than-expected December jobs report. The consensus expectation for nonfarm payrolls from the Bureau of Labor Statistics (BLS) was a small gain of 50k; but instead payrolls fell by 140k—the first decline since last April. Before I get to the typically-discussed details of the report, I wanted to point out a statistic that didn’t receive a lot of attention on Friday. Women actually lost 160k jobs last month, vs. a gain of jobs for men. Sadly, COVID continues to wreak disproportionate turmoil on women in the workforce—yet another example of the “K” nature of the pandemic (a sea of haves vs. have-nots).

A positive offset to December’s weakness was a significant upward revision to November’s payrolls; which were revised up from 245k to 336k. Summing up December’s weakness with prior payroll gains, as you can see below, we still have nine million jobs to go before we get back to pre-pandemic levels.

Payrolls’ Level

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics, as of 12/31/2020.

Bright, and not-so-bright, spots

The Household Survey, from which the unemployment rate is calculated, also had some data to cheer. Those working part-time for “economic reasons” fell 471k—to a nine-month low—while full-time jobs rose by 397k. There were also positive headlines around the 0.8% surge in average hourly earnings (AHE); but lost in the headline cheering was the fact that the huge job losses in leisure/hospitality (discussed below) have some of the lowest wages. Remember how math and averages work: you eliminate a bunch of smaller numbers from an average, and the average increases. In addition, the index of aggregate hours worked fell 0.4% last month, which was the first decline since last April.

Even if we weren’t in the midst of the virus’ resurgence, along with regional lockdowns/restrictions, simple math was going to dictate a less-robust phase of job growth. The initial reopening of the economy last spring allowed many workers to come back; and thus led to a spike in job growth (first chart below), and a commensurate decline in temporary layoffs (second chart below).

Payrolls’ Monthly Change

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics, as of 12/31/2020.

Temporary vs. Permanent

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics, as of 12/31/2020.

Scarring

As seen above, one trend that improved last month was the number of permanent job losses; while on the other hand, temporary unemployment increased slightly, driven by weakness in leisure and hospitality. Permanent job losses represent a key “scarring” impact on the economy of severe recessions/crises; and we will be keeping a close eye on future trends.

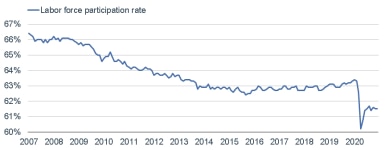

Scarring can also be seen in long-term unemployment—notably the percentage of the unemployed who have been so for at least 27 weeks. As you can see in the first chart below, at present, the long-term unemployed now account for more than 37% of the unemployment rate—which itself was unchanged in December and remains at 6.7%. As we’ve seen in cycles past, the longer this cohort remains without jobs, the more difficult it becomes for them to find jobs; while it also increases the likelihood they opt to drop out of the labor force altogether. The labor force participation rate (LFPR), seen in the second chart below, has stalled. It’s improved from the pandemic low; but like payrolls, there remains a lot of ground to make up relative to pre-pandemic levels (which in turn were historically low).

Unemployment Rate vs. LT Unemployment

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics, as of 12/31/2020.

LFPR Stalling

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics, as of 12/31/2020.

Small business trends

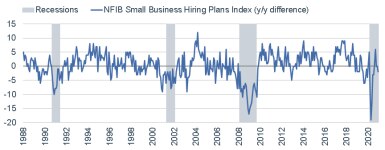

These labor market scars also do not pair well with a labor quality issue facing U.S. businesses. According to the National Federation of Independent Business (NFIB), labor quality has rebounded to the number one spot in terms of responses to the NFIB’s survey question about small companies’ most significant concern (first chart below). On top of that, small businesses’ hiring plans have turned back down, as you can see in the second chart below.

“Skills Gap” Back

Source: Charles Schwab, Bloomberg, National Federation of Independent Business (NFIB), as of 11/30/2020.

Hiring Plans Back in Red

Source: Charles Schwab, Bloomberg, National Federation of Independent Business (NFIB), as of 12/31/2020.

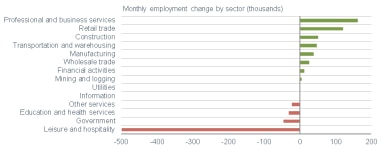

Looking further under the hood of Friday’s jobs report, you can see in the chart below (and as mentioned above), the leisure and hospitality sector was the hardest-hit—losing nearly 500k jobs in December alone. Leaving that sector aside though, payrolls’ breadth was more positively skewed, with eight sectors showing job growth vs. six that showed job losses. The data also continues to show that the goods sector has been able to recover much faster than the services sector given social distancing measures.

Leisure/Hospitality Jobs Sink

Source: Charles Schwab, Bureau of Labor Statistics, as of 12/31/2020.

In sum

The weakness in payrolls, coupled with Democrats’ effective control of all three branches of government, paves the way for additional fiscal relief to be passed by Congress in the near-term. This additional relief (on top of the most recent round of stimulus checks) can help bridge the chasm created by the pandemic. However, the nature and depth of the COVID crisis and the attendant recession means there will likely be longer-term scars that will take time to heal.

Scarring was highlighted recently in Working Paper No. 27439 from the National Bureau of Economic Research (NBER)—the official arbiters of recessions. They cite scars in terms of the labor market; but also in terms of beliefs. The paper’s abstract:

“The largest economic cost of the COVID-19 pandemic could arise from changes in behavior long after the immediate health crisis is resolved. A potential source of such a long-lived change is scarring of beliefs, a persistent change in the perceived probability of an extreme, negative shock in the future. We show how to quantify the extent of such belief changes and determine their impact on future economic outcomes. We find that the long-run costs for the U.S. economy from this channel is many times higher than the estimates of the short-run losses in output. This suggests that, even if a vaccine cures everyone in a year, the COVID-19 crisis will leave its mark on the U.S. economy for many years to come.”