Rise Up: Vaccines Brought Broader Market Participation

Key Points

The market’s tenor changed in early September as economic optimism began to pick up; kicked into even higher gear since positive vaccine news erupted.

Rotations have been in fits-and-starts; and with changing characteristics; however, euphoria and speculative froth has become a risk heading into 2021.

Investors should maintain discipline around diversification and rebalancing.

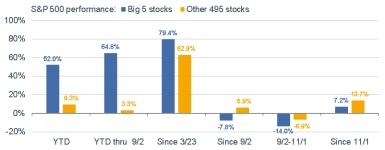

September 2 was a momentous day on several fronts. It was the initial pop to all-time highs for both the S&P 500 and NASDAQ; after an impressive run from the March 23 pandemic low. It was also a turning point in terms of market leadership; reflecting budding optimism about a turn-for-the-better in economic data. As of the close on September 2, the spread between the performance of the “big 5” and the “other 495” hit its peak—at a whopping 62 percentage points. The chart below plots the spread on a rolling daily year-to-date (YTD) basis, through Friday’s close.

Big 5 knocked down a notch

As a reminder, the “big 5” are the largest five stocks in the S&P 500 index: Apple, Microsoft, Amazon, Google (Alphabet) and Facebook. By the way, these stocks often get lumped together as “tech” stocks; but the reality is they span three distinct sectors: Apple and Microsoft are in the Technology sector, Amazon dominates the Consumer Discretionary sector, and Google and Facebook are in the Communication Services sector. Because the S&P 500 is a capitalization (cap)- weighted index, the big 5’s weighty caps brought them to nearly 25% of the overall index as of early September.

Big 5 Has Trounced Other 495

Source: Charles Schwab, Bloomberg, as of 12/11/2020. Big 5 stocks include Alphabet, Amazon, Apple, Facebook, and Microsoft. Past performance is no guarantee of future results.

As you can see below (and via the spread above), YTD through September 2, the big 5 were up 65%; while the entire remainder of the S&P 500 were up only 3%. I typically cite this spread when I get the oft-asked question about the perceived disconnect between the stock market and the economy. At least at that point in the cycle; a market rewarding only a select handful of stocks at the expense of much weaker performance throughout the remainder of the index; was a bit reflective of economic conditions.

Big 5 Dominance Waning

Source: Charles Schwab, Bloomberg, as of 12/11/2020. Big 5 stocks include Alphabet, Amazon, Apple, Facebook, and Microsoft. Past performance is no guarantee of future results.

To add some color, as of September 2, there were still more than 36% of the S&P 500’s stocks still in bear market territory—defined as still down at least 20% from their 52-week highs. Again, that was reflective of an economy still seen as in peril in early September. Remember, we ultimately wouldn’t get the initial read on third quarter real gross domestic product (GDP) until late-October (it surged 33% on a quarter-over-quarter, annualized rate).

Rotation era begins

Since September 2, a series of sharp rotations has been underway; albeit in fits-and-starts. These rotations have arguably helped ease some of the speculative froth witnessed in the big 5 stocks leading up to the September 2 highs. As you can see, since then, the big 5 stocks are down nearly 8%; while the other 495 stocks are up nearly 6%. This has been instrumental in shifting the ratio of the cap-weighted S&P 500 index to its equal-weighted version. As you can see below, the ratio peaked on September 1 (a rising line means cap-weighted is outperforming equal-weighted); since which time the equal-weight index has been performing better.

Cap-Weighted S&P Dominance Fading

Source: Charles Schwab, Bloomberg, as of 12/11/2020. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance does not guarantee future results.

Depending on the day, week or even month you were looking at, the rotations underway since September 2 could be defined with any number of characterizations:

- Growth to value

- Large cap to small cap

- Defensives to cyclicals

- “Stay at home” stocks to “get out and about” stocks

- COVID winners to COVID losers

- Market leaders to market laggards (“catch up trade”)

Winners vary by timeframe

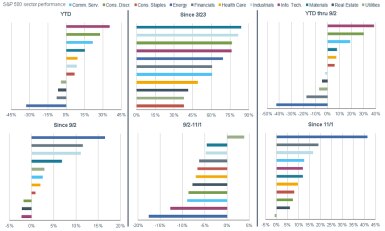

Since early November, the flavor of the market’s rotational tendencies has been more directly tied to the initial success of the COVID-19 vaccine trial results—and eventual roll-out, which is starting today. Below is a series of charts, covering various key time periods, and showing leadership by sector. The top three versions cover YTD, since the market’s pandemic low on March 23 and YTD through September 2 (which is when the big 5’s dominance began to recede). The bottom three versions cover three distinct periods since the rotation era began: since September 2; between September 2 and November 1; and what we can think of as the “vaccine” era since November 1.

Sector Trends by Timeframe

Source: Charles Schwab, Bloomberg, as of 12/11/2020. Sector performance data is based on total return for each S&P 500 sector subindex. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly Past performance is no guarantee of future results.

On a YTD basis—through last Friday as well as through September 2, tech stocks remain the winners; with energy bringing up the rear. However, since the bull market began in March, the Materials and Industrials sectors are in the lead (two of the most cyclical sectors); while the defensive Consumer Staples and Utilities sectors have lagged considerably.

Since early September, the rotations have been inconsistent. Following September 2’s all-time highs for the S&P 500 and NASDAQ, the big 5 have been relative underperformers. Since September 2, it’s the prior laggards of Energy and Financials that have been the winners; with Technology bringing up the rear. However, between early September and early November, there was a defensive rotation that took place—with Utilities the only winner during a span that included (for the overall S&P 500) a near-10% correction in September and a near-8% pullback in October.

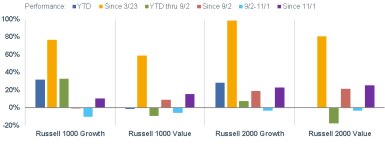

A stylish market

Since early November, it’s been back-to-the-races for the Energy Sector; with defensive Utilities the only sector in the red. In terms of how these rotations have manifested themselves on the style front; below you can see the performance comparisons of Russell 1000 (large cap) Growth/Value and Russell 2000 (small cap) Growth/Value. Large cap growth persists as the YTD and since March 23 low winners; however, both large and small cap value have been the winners since September 2.

Style Trends by Timeframe

Source: Charles Schwab, Bloomberg, as of 12/11/2020. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

As a reminder, in mid-November, we closed out a tactical view we had had in place since March 2017 to overweight large caps (S&P 500) and underweight small caps (Russell 2000). It was not a shift in favor of small caps—just a shift to “neutralize” the view and eliminate the bias. Since the change to our tactical view, the Russell 2000 is up more than 7%, while the S&P 500 is up only 1%. Also as a reminder, we currently have outperform ratings on Financials and Healthcare; and under-perform ratings on Utilities and Consumer Staples (check out David Kastner’s latest sector views here.

As the economic growth outlook has improved—in large part thanks to coming vaccines—the tenor of the market’s leadership has shifted away from the concentration of a few dominant leaders. As we’ve noted, the vaccine does indeed represent a light at the end of the tunnel; however the resurgent virus means we remain in the tunnel economically. This helps to explain the fits-and-starts of rotations underway since early September.

Beware euphoria

The success of the market this year has bred what I believe is its most significant risk at present—elevated optimistic sentiment. I detailed this in my 2021 outlook; but the CliffsNotes version is that nearly all behavioral and attitudinal measures of sentiment show at best complacency, and at worst speculative froth. There have been myriad comparisons between today’s markets and the 2000 tech bubble era; but perhaps a better comparison would be to 2009-2010 as we look ahead to 2021. In March of 2009, stocks finally bottomed after a brutal 17-month bear market accompanied by a massive financial crisis. In March of 2020, stocks bottomed after a brutal (but incredibly short) bear market accompanied by a massive health/economic crisis. By December in both years, the S&P 500 had staged impressive ~65% rallies, as you can see in the chart below. But like in late 2009, the market’s surge bred euphoric sentiment conditions—setting the stage for what were two corrective phases in 2010 (~7% from mid-January to early-February and ~16% from late-April to early July).

2009-2010 Redux?

Source: Charles Schwab, Bloomberg, as of 12/11/2020. Past performance is no guarantee of future results.

That is not necessarily the playbook for 2021—and seasonal tendencies remain on the bulls’ side for now—but elevated sentiment does suggest the market is more vulnerable to the extent a negative catalyst emerges. The market’s better breadth—including stronger equal-weighted performance by the S&P 500 is a positive offset; and historically has kept sentiment-related pullbacks from becoming more serious corrections. But we do suggest investors remain disciplined—especially with regard to diversification (across and within asset classes) and periodic rebalancing.