Omicron: Will the Virus Wave Pattern Repeat?

As we wrote about in our 2022 Global Outlook, COVID-19 is becoming endemic rather than pandemic. We anticipate a winter wave of COVID, potentially with new variants like omicron.

Policymaker responses are likely to determine the variant's economic and market impact. Although some countries were already taking some steps to slow winter outbreaks, we haven't seen new lockdowns in response to omicron. At the same time, more countries—especially those in Europe—are moving toward mandatory vaccination requirements, potentially giving a boost to stalled vaccination rates. Some new measures that governments have announced in the past week to try to combat the virus include:

• Germany announced on Thursday that only vaccinated (or recovered) people will be allowed into restaurants, theaters, and non-essential stores. A vaccine mandate, backed by new Chancellor Olaf Scholz, will go to a vote in parliament in the coming weeks.

• In Greece, the government is making vaccines mandatory for all citizens over age 60. Beginning in January, the unvaccinated must pay a fine of 100 euros ($113) every month for non-compliance.

• Austria, burdened with one of the lowest vaccination rates in western Europe, will remain in lockdown until December 12. At that time, it will be lifted specifically for the vaccinated and those recently recovered from the virus. The unvaccinated can still go to work, contingent upon a negative COVID test. Officials are also working on plans to impose mandatory vaccinations, to begin in February.

Vaccination rates had been stalling prior to omicron

Source: Charles Schwab, Bloomberg data as of 12/5/21.

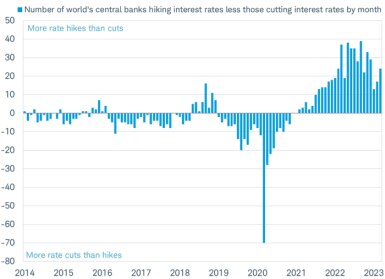

It's been only a few weeks, but so far, these policies don't appear likely to derail above average global growth. In fact, omicron does offer a potential reason for central banks to reconsider the pace of rate hikes in the coming months. This suggests the awaited December rate hike by the Bank of England (BoE) may get pushed out yet again. Market-based odds of a BoE rate hike at the December 16 meeting went from over 50% on Nov 24, the day before the omicron news, and has since plunged to around 20%, as you can see in the chart below.

Omicron changes odds of a December rate hike

Source: Charles Schwab, Bloomberg data as of 12/5/21.

Initial answers on the ability of the vaccines to fight the omicron variant may start to come this week. Reduced ability to neutralize the virus is expected. It may be another week or two before we know whether vaccines still provide effective protection or if the illness caused by the variant is milder in unvaccinated and more vulnerable populations.

The global stock market, measured by the MSCI World Index, has shed 3% since the news of omicron broke on November 25, accompanied by higher volatility with daily moves both up and down. Although prior COVID waves tended to be buying opportunities, markets may remain volatile over the next couple of weeks as more information on omicron becomes available.

There are downside risks should policymakers be forced to add more economically impactful restrictions. A rapid rise in cases and the increased reinfection risk means hospitals could be overwhelmed again, even with milder cases that result in shortened hospital stays relative to the delta variant. But there are upside risks as well. If omicron is more transmissible—but causes a much milder illness—then it may outcompete delta to become the dominant strain. A more dominant but milder variant may result in a slowdown of hospitalizations and deaths, as cases climb. Should the threat of future lockdowns fade, a more confident growth outlook may emerge. Along with it, a potential acceleration in the labor supply, a pickup in output and easing of inflation pressures. But it's too early to tell, and the market is moving both up and down on the news flow.

Here is the behavior the global stock market has tended to follow in previous virus waves. We have shared the chart below many times this year. As the number of global COVID cases rises, tech stocks (lockdown leaders of working and shopping from home) have outperformed energy stocks (reopening beneficiaries of a return to travel) with a rising blue line, and when the number of cases retreats, energy outperforms tech driving the blue line back down again.

Familiar pattern playing out again

Source: Charles Schwab, Bloomberg data as of 12/5/21. Past performance is no guarantee of future results.

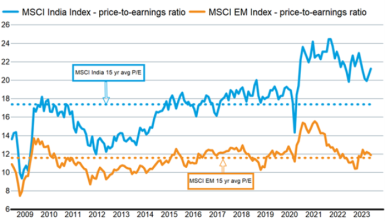

The repeating pattern suggests a continued rise in cases for at least the rest of the month of December (prior waves saw a two month climb from trough to peak) accompanied by outperformance of tech stocks for the rest of the month. Yet, this outbreak may not be unfolding the same way. Tech stocks have failed to make new relative highs to energy since the news of omicron broke. One reason might be that the valuations of the lockdown leaders are now very high relative to reopening beneficiaries, as you can see in the chart below.

Tech stocks much more expensive than average while energy stocks

less expensive

12 month forward price-to-earnings ratio for MSCI World Index sectors. Source: Charles Schwab, Factset data as of 12/5/21.

Another reason: Analysts' earnings expectations for the beneficiaries of the pandemic are much more optimistic than in earlier cycles. These market conditions could contribute to less scope for the latest wave of the sector rotation. There is potential for further rotation toward the lockdown leaders if omicron worsens, but it may be less pronounced than in prior waves.

The takeaway may be that we shouldn't necessarily expect this wave to unfold the same as the others. And the rest of the month may hold policymaker responses to what we don't yet know about omicron's effects, resulting in continued volatility. This may be tempered by a potential delay in monetary policy tightening and a backdrop of strong global economic growth.