Managing Cash-Secured Equity Puts

Designed to generate short-term income or purchase desired stocks at a favorable price, writing cash-secured equity puts, or CSEPs, is a bullish strategy that many traders find appealing. However, it's important to have the proper expectations before you establish the position(s). While the ideal candidate is a stock with which you’d be comfortable with either outcome, you might not continue to feel that way if the stock drops sharply. Therefore, it is important to know what to do if the CSEP doesn't work out as planned.

How do you create a CSEP?

A CSEP is generally written out-of-the-money (OOTM), meaning at a strike price that is below the underlying stock's current price. A CSEP is essentially the same strategy as an uncovered (naked) put, except that with a CSEP, you need cash in your account equal to the total amount of the potential assignment, in the event the stock shares are assigned (put) to you.

CSEPs can be a good strategy if you're willing to buy a stock that you're bullish about in the long term, but you think it might drop a little in the short term. Keep in mind that a big drop in the stock price might force you to buy the stock above the market price at the time of assignment. And while you might be unhappy with that outcome, you'd be no worse off than if you had already owned the stock.

Before selling a CSEP, always ask yourself, "Would I be okay with buying the underlying stock at the strike price on this option?" If you can answer yes, then writing a CSEP is a strategy you may want to consider.

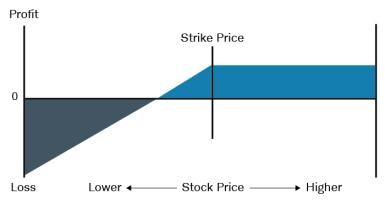

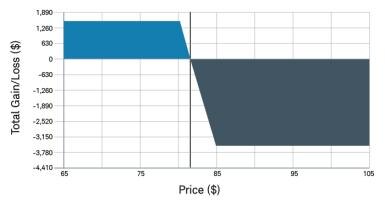

Profit and Loss Profile for a CSEP

Source: Schwab Center for Financial Research

If you sell OOTM CSEPs and the underlying stock remains relatively stable or increases in value, the options will eventually expire worthless. Sometimes, however, the stock may end up very close to the strike price or go down enough to end up in-the-money (ITM). What you choose to do next depends on whether or not your opinion about the stock has changed. Are you more or less bullish, or perhaps you’ve turned bearish? Let's explore six possible alternatives.

1. Expiration: Do nothing and let your options expire worthless.

If the underlying stock has remained relatively flat or increased slightly, your CSEPs may be OOTM as the expiration date approaches. In this situation, the best course of action may be to let your OOTM CSEPs expire worthless. When this occurs:

- The options will be automatically removed from your account.

- The net credit from the original sale of the options will be retained in the account with no further obligation.

- Note that this is the maximum profit that can be earned on CSEPs.

At this point, if you are still at least moderately bullish on the underlying stock, you can sell new CSEPs for a later month; if not, you’re done.

Sometimes as the expiration date approaches, the underlying stock may be very close to the strike price and you can't determine whether you will be assigned or not. If you're willing to take the risk, you can simply do nothing and if the options are exactly ATM (at-the-money) or OOTM, they will most likely expire worthless. When this occurs:

- The CSEPs will be automatically removed from your account.

- The net credit from the original sale of the options will be retained in the account and you have no further obligation.

At this point, if you're still at least moderately bullish, you can sell new CSEPs for a later month; if not, you’re done.

If the options expire ITM and you're assigned, keep reading.

2. Assignment: Do nothing and let the stock be put to you at or before expiration.

If your CSEPs expire ITM and you do nothing, you will most likely be assigned and required to purchase the underlying stock at a price equal to the strike price of the CSEPs. This could occur prior to expiration or at expiration; unless you have become bearish on the stock, this may be an acceptable outcome.

If your CSEPs are only slightly ITM, this is usually a good thing. You just purchased a stock on which you were bullish, at a price you originally deemed favorable, and your overall net cost basis will actually be lower than the strike price.

If your CSEPs expire deep ITM, your net cost basis could exceed the current market price of the stock. While you could have an unrealized loss at this point, your overall basis will still be lower than if you had purchased the stock on the day you originally sold the CSEPs. When you are assigned, the CSEP will be automatically removed from your account and the underlying stock position will be placed in your account. You also will be charged for the purchase of the stock at the strike price of the option.

Sometimes options assignments occur prior to expiration. While this is somewhat rare for CSEPs, it may occur when a long put holder chooses to exercise in order to establish a short stock position, or because the underlying stock pays a dividend. Options prices are not adjusted for normal quarterly dividends. As a result, an owner of protective long puts that has become bearish on the stock may decide to exercise the puts on the ex-dividend date in order to sell the stock but receive the very last dividend payment. This generally happens when the put options are ITM and the amount of the dividend exceeds the remaining time value in the options, or if the bid price of the options has dropped below the intrinsic value.

This incentive exists because the strike price the owner of the puts will receive for the stock is the same before or after the ex-dividend date. However, if the owner waits at least until the ex-dividend date, then they will be the owner of record when the next dividend is paid. While this risk is relatively small, if you intend to sell CSEPs on dividend paying stocks, take note of the ex-dividend dates. If you are willing to take this risk, keep reading.

3. Close-out: Buy back the CSEPs at a gain or loss.

Let's say that you've sold CSEPs on a stock and the stock price rises faster than you expected. However, you're concerned that the price may come back down before expiration. One course of action may be to close out your CSEPs by buying them back in the market, which under these circumstances can usually be done at a gain.

If you have chosen to sell CSEPs on a dividend-paying stock and the options are ITM as the ex-dividend date approaches, you can sometimes avoid early assignment by buying back the CSEPs before the ex-dividend date (at either a gain or a loss).

Keep in mind that as a CSEP seller (writer), you have assumed an obligation to buy the underlying stock any time the put owner (buyer) chooses. While early assignments generally occur on the ex-dividend date, they can happen any time your CSEPs go ITM.

If your CSEPs go ITM any time prior to expiration and you simply want to avoid further losses, you can usually close out your CSEPs by buying them back in the market, usually at a loss.

4. Rollout: Buy back your CSEPs and sell same strike CSEPs for a later month.

Sometimes as the expiration date approaches, the underlying stock may be very close to the CSEP strike price and you can't determine whether you will be assigned or not. If you are indifferent about getting assigned, then simply do nothing.

If you're still bullish on the underlying stock in the long term, but believe that further downside risk is possible in the short term, consider a rollout. A rollout closes out the existing CSEPs of the current month and simultaneously sells CSEPs with the same strike price for a later month. Schwab's trading platforms have a rollout screen that is specifically designed for this purpose.

When your near-month CSEPs are close at the money (ATM), a rollout to a later month can usually be entered at a net credit. This is because the time value on an option with a later expiration will usually exceed the time value on a nearer option. This is especially true for options that are ATM, because they generally carry the greatest amount of time value.

However, if the options are deep ITM or way OOTM, the difference in time values may be so small that the spread between the bid and ask will cancel the time value out and the rollout can't be done at a net credit. In this situation, a same strike rollout may not be the best course of action.

Let's look at a couple of examples.

Example: Even strike rollout

Assume stock BAAA is currently trading at $74.13 and your July 85 puts are $10.87 ITM. In the below screenshot, notice that the bid at the quoted market price of $10.35 is currently $0.52 below the intrinsic value. The August 85 puts are priced slightly above the July contracts and they have $0.33 in time value. However, this difference is not enough to offset the wide spread between the bid and ask prices.

Source: StreetSmart Edge®

In this example, an even strike rollout, if entered at the market price, would require a $0.05 debit and may not be a prudent trade because it simply postpones the (most likely) inevitable assignment for another month, and it costs money to do so. Alternatively, you could buy back the CSEPs to close, but you might have to pay $0.38 in time value, since they are $10.87 ITM but have an ask price of $11.25. In this situation, it might be wise to enter a limit order for at least a small credit, but if the order fails to execute, consider just accepting the assignment and purchase of BAAA at $85.00. While this is well above the current market price and would likely result in a loss, depending upon the price at which you originally sold your CSEPs, your overall cost basis could still be below $85.00.

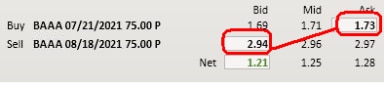

For comparison, in the screenshot below, stock BAAA is currently trading at $74.13 and your July 75 puts are ITM by only $0.87. You could enter this rollout for a net credit of $1.21, which represents one month's worth of time value and lowers your overall cost basis by $1.21 if you eventually get assigned. This even strike rollout would postpone a likely assignment (for now) and generate an additional $121 cash per hundred shares (not including commissions). If your outlook on BAAA is still short-term bearish but long-term bullish, this might be a prudent trade.

Source: StreetSmart Edge®

Example: Turn your CSEPs into a spread

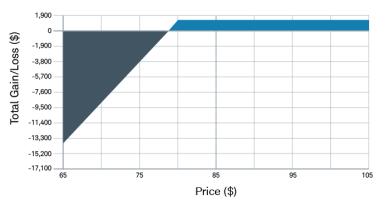

It is early July, and you are bullish on PPGG, which is currently priced at $83.65. However, you think PPGG could have a small price dip in the near term, so rather than buying 1,000 shares now, you decide to make the following CSEP trade:

Sell 10 PPGG Aug 80 Puts @ 1.00 (to open)

Net credit = $1,000 (1.00 x 10 x 100)

Days until expiration = 40

Breakeven = $79.00 (strike price – option premium)

Max loss = $79,000 ([0 – breakeven price] x 1000)

Max loss occurs at 0, at expiration

Max gain = $1,000 (net credit)

Original CSEP Position

Source: Schwab Center for Financial Research

Two weeks later, PPGG has dropped to $81.00 and your puts have increased to $1.50. As a result, you have an unrealized loss of -$500. What should you do? If you do not anticipate further downside in PPGG, you might consider just taking the assignment (see “Assignment: Do nothing and let the stock be put to you at or before expiration,” above. On the other hand, if you're uncertain about the future direction of the stock given its recent decline, keep reading.

5. Create a bullish put spread by buying some lower strike puts for the same month.

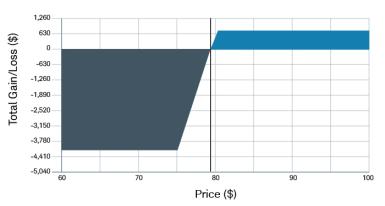

If you have at least level 2 (spread trading) option approval, and you are still bullish but have become more concerned about protecting your downside, consider converting the original CSEP into a bullish put spread by buying some puts with a lower strike price.

Sell 10 PPGG Aug 80 Puts @ 1.00 ◄original position

Buy 10 PPGG Aug 75 Puts @ .25 ◄new position

Net debit = $250 (.25 x 10 x 100)

Days until expiration = 26

Breakeven = $79.25 (short strike – total net credit) or $80.00 – (1.00 – 0.25)

Max loss = $4,250 (difference in strikes – net credit)

Max loss occurs at $75.00 or below at expiration

Max gain = $750 (net credit from all trades)

Max gain occurs at $80.00 or above at expiration

Net New Bullish Put Spread Position

Source: Schwab Center for Financial Research

The effect of the new bull put spread is that while your breakeven price only went up a little (from $79.00 to $79.25), you have sharply reduced your downside risk (from $79,000 to $4,250). Your immediate unrealized loss has increased slightly (from –$500 to –$750) if the stock stays about where it currently is and you will earn your maximum gain at expiration. The stock can continue to move lower (by up to 1.75 more points) before you will sustain losses.

6. Create a bearish put spread by buying some higher strike puts for the same month.

Let's say that you have decided that you'd rather not own PPGG after all, because you are now bearish. You can convert the original CSEP into a bearish put spread by buying some higher strike puts.

Sell 10 PPGG Aug 80 Puts @ 1.00 (to open) ◄original position

Buy 10 PPGG Aug 85 Puts @ 4.50 (to open) ◄new position

Net debit = $4,500 (4.50 x 10 x 100)

Days until expiration = 26

Breakeven = $81.50 (long strike – total net debit) or $85.00 + (1.00 – 4.50)

Max loss = $3,500 (net cost of both trades)

Max loss occurs at $85.00 or above at expiration

Max gain = $1,500 (difference in strikes – net cost of both trades)

Max gain occurs at $80.00 or below at expiration

Net New Bearish Put Spread Position

Source: Schwab Center for Financial Research

By buying the higher strike puts and converting your CSEPs into a bearish put spread:

- A substantial additional capital investment of $4,500 would be required.

- The spread is already ITM by 0.50 and the maximum gain can be obtained with an additional $0.50 drop in price.

- The maximum gain is now $1,500 instead of $1,000 as it was originally.

It is very important to be sure that you are bearish on PPGG before you create this spread, because if PPGG increases above $81.50, losses will begin to mount very quickly.

In conclusion

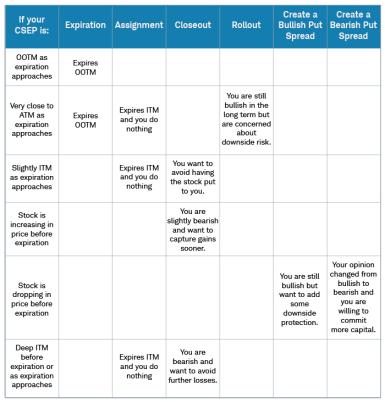

The matrix below summarizes the various alternatives I have described above:

Source: Schwab Center for Financial Research

Key points to remember:

- While a CSEP is used primarily as an income-generating strategy, you should only consider a CSEP on a stock you would be comfortable owning.

- If the price of the underlying stock drops substantially prior to the expiration date of the CSEP, your losses could be significant. Losses would be limited to the strike price down to zero minus the premium you received on the sale of the puts.

- A significant increase in the price of the underlying stock will generally result in a profitable trade, but your profit will be limited to the premium you receive on the sale of the CSEPs. You wouldn't lose money, but you would lose an opportunity to profit on a long position in the stock.

- Keep in mind that if your put options go ITM, you could be assigned at any time.

By

By