Lesson Learned? Takeaways From the GameStop Saga

Key Points

The past two weeks’ roller-coaster ride on GameStop and other heavily-shorted stocks can serve as a valuable lesson to many newly-minted day traders and speculators.

But the ongoing democratization of investing is a long road on which we will all continue to travel; though over a few speed bumps along the way.

It’s not what you know that will make you a successful investor; it’s what you do.

There is a generic, but common, pair of terms often used to describe individual investors/traders and professional investors/traders: “dumb” and “smart” money, respectively. Given how successful individuals have been during the pandemic bull market—but in particular, with regard to a very unique past few weeks—perhaps the labels should be changed to Davids and Goliaths. Two weeks ago, a tidal wave of retail traders—or Davids—descended on a small subset of the stock market; leaving the smart money—or Goliaths—in a state of shock and awe. It was relatively short-lived though.

Before getting to the meat of that story, let’s first point out that the Davids have done quite well over the past year or so. The chart below shows Goldman Sachs’ index of “retail favorites” (the 50-60 stocks most popular with the retail trading community), which have performed extraordinarily well relative to the S&P 500; especially since last spring.

Retail Favorites Trouncing S&P 500

Source: Charles Schwab, Bloomberg, as of 2/5/2021. Data indexed to 100 (base value = 3/23/2020). The Goldman Sachs (GS) retail favorites basket consists of U.S. listed equities that are popularly traded on retail brokerage platforms. Past performance is no guarantee of future results.

Get shorty

The last two weeks though was a story of a much smaller subset of stocks than imbedded in the “retail favorites” index above. That subset was heavily-shorted stocks, with the poster child becoming GameStop (ticker: GME). That stock, and to lesser degree a few others, had been aggressively touted on the Reddit subgroup r/wallstreetbets, with millions of subscribers. GameStop—a classic brick-and-mortar, often mall-based retailer selling video games—had been much maligned, given the trend toward all things online and digital. As such, it became a heavily-shorted stock among the hedge fund community. As a refresher, when an investor shorts a stock, it borrows shares at the current price in the hopes of buying them at a lower price in the future.

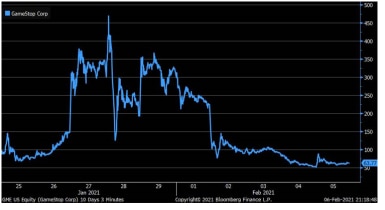

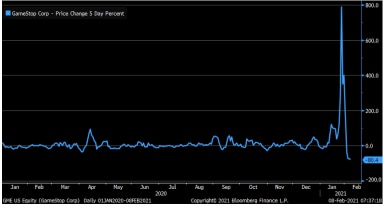

The two charts below show the stock price of GME in two different ways. The first is a short-horizon look at the stock and its intra-day price behavior over the past two weeks. The second is a longer-horizon look at the stock, showing its five-day percent change on a closing basis. Both are eye-popping. In the case of the second chart, GME fell more than 80% last week, after a string of triple-digit gains—the peak of which was nearly 800% as of the close on January 27. The Reddit-fueled “flash mob” initially drove the stock up exponentially; forcing investors who were short—notably Melvin Capital, a large hedge fund—to “cover their shorts” (buy back the stock); which further fueled the rise. But in the blink of an eye, it was over…but not before capturing the attention of Wall Street’s regulators (a saga that is just beginning to play out).

GME’s Wild Ride (Intraday)

Source: Charles Schwab, Bloomberg, as of 2/5/2021. Past performance is no guarantee of future results.

GME’s Wild Ride (5-Day %)

Source: Charles Schwab, Bloomberg, as of 2/5/2021. Past performance is no guarantee of future results.

The chart below is a Goldman Sachs-created index of the most heavily-shorted stock within the broad Russell 3000 universe. I indexed it to March 23, 2020, which was the bottom of the pandemic bear market that began only a few weeks prior to that, on February 19. As you can see, heavily-shorted stocks performed well off the market’s trough; but really took off as we entered 2021.

Most-Shorted Stocks Take Breather

Source: Charles Schwab, Bloomberg, as of 2/5/2021. Data indexed to 100 (base value=3/23/2020). The Goldman Sachs (GS) most-shorted basket contains the 50 highest short interest names in the Russell 3000; names have a market cap greater th

an $1 billion. Past performance is no guarantee of future results.

There are already movies and books in the works about the saga; but the most important message, from my perch, is the growing acknowledgement that the playing field continues to get leveled for individual investors. That’s not to say there isn’t a knowledge/experience gap still to be narrowed; with the round-trip in GME hopefully a valuable lesson to newly-minted day traders. The key, and certainly our mission at Schwab, is to transition these newly-minted day traders into successful long-term investors.

Speaking of lessons…

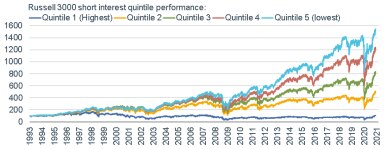

Time horizon is always key, especially when gauging past performance as a guide to future results. Notwithstanding the round-trip in GME, a look at the most-shorted stocks index chart above might lead an investor to think this is a winning strategy longer-term. That is decidedly not the case. The chart below goes back to 1993 and breaks the Russell 3000 into quintiles based on short interest. Quintile 1 contains stocks with the highest short interest (i.e., most heavily-shorted stocks); while quintile 5 contains stocks with the lowest short interest (i.e., least heavily-shorted stocks). As is clear, there is a near-perfect inverse correlation—with the most heavily-shorted stocks having the worst performance, and the least heavily-shorted stocks having the best performance (by a wide margin). The moral of this story is that the recent spike higher in the performance of heavily-shorted stocks is an aberration, not a common occurrence.

Most-Shorted Stocks Historically Not Winners

Source: Charles Schwab, Strategas Securities, LLC, as of 2/3/2021. Data indexed to 100 (base value=3/12/1993). Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

In addition, there has been a steadily-decreasing interest in short-selling. As seen in the chart below, courtesy of our friends at SentimenTrader (ST), the average stock across the S&P 500, Dow Jones Industrials, NASDAQ 100 and Russell 2000 indexes only has about 2% of its float sold short—a 17 year low. Across the entire New York Stock Exchange universe, the ratio is the lowest in 20 years.

17-Year Low in Short Interest

Source: Charles Schwab, SentimenTrader, as of 2/4/2021. For illustrative purposes only.

There has been much consternation about, and criticism of, short-selling in the wake of the GME saga. However, as noted by ST, one of the main benefits of a healthy base of investors willing to sell short is that it helps keep companies honest. Instead of the rah-rah “great quarter guys” from many analysts whose companies have investment banking relationships, shorts cast a skeptical eye and are willing to ask tougher questions. Perhaps today, it’s quite important. As companies emerge from the chaos of last spring, many of them continue to lose money.

Speaking of losing money…

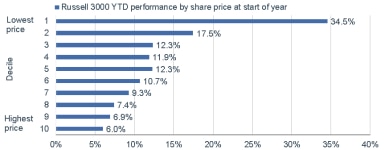

Heavily-shorted stocks have not been the only recent “low quality rage.” Check out the charts below of non-profitable technology stocks, weak balance sheet stocks (relative to strong balance sheet stocks); as well as the performance of stocks year-to-date by stock price deciles. In the case of the last chart, the underlying theme has been aggressive buying of “penny stocks.”

Non-Profitable Tech Stocks’ Continued Ascent

Source: Charles Schwab, Bloomberg, as of 2/5/2021. Data indexed to 100 (base value = 3/23/2020). The Goldman Sachs (GS) basket consists of non-profitable U.S.-listed companies in innovative industries. Technology is defined quite broadly to include new economy companies across GICS industry groupings. Past performance is no guarantee of future results.

Weak Balance Sheet Stocks Catch Up

Source: Charles Schwab, Bloomberg, as of 2/5/2021. Data indexed to 100 (base value = 3/23/2020). The Goldman Sachs (GS) strong and weak balance sheet baskets each contain 50 S&P 500 companies across eight sectors with strong and weak balance sheets, respectively. Past performance is no guarantee of future results.

Low Price Stocks’ Surge

Source: Charles Schwab, Bloomberg, as of 2/5/2021. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Low-quality themed rallies can persist; and my ever-foggy crystal ball isn’t equipped to enlighten us as to when some of this frenzy begins to falter. Bulls point to easy monetary conditions courtesy of the Federal Reserve; but at some point, actual fundamentals will again drive markets and their underlying securities.

Comeuppance

My friend and prolific author/columnist Zachary Karabell put it well in a recent article in Time:

“The current rage and nihilism that fueled some of this bidding up of companies have been teetering … is a volatile force that can wreak havoc no doubt. Populist anger in politics can lead to reform, but it can also lead to demagoguery and the erosion of trust and democracy. Retail investors flexing their muscle, empowered by social media and by new trading apps … can be a comeuppance for complacent and arrogant financial elites but also an ornery genie freed from a bottle with no intention of going back in or playing by any rules.”

Karabell had this figurative exclamation point at the end of the article:

“It’s right to be a tad worried when new forces are unleashed: splitting the atom can electrify a city or destroy it. But what we’ve seen on Wall Street is a surge unlike any other before it: the volatile emergence of individual investors, not rich, not privileged, not professional but with the keen wisdom of the crowds able to spot an opportunity and ride it. It’s best not to tut-tut the quicksilver power on display. It’s vital to respect it, to be humble in the face of it, and to start adjusting to the democratization of the markets.”

Frothy sentiment

Even before the wild-and-crazy action of the past couple of weeks, I’ve been expressing my view that the market’s success—especially since early November when we started to get positive COVID vaccine news—has bred its greatest risk, which is excessively optimistic and/or speculative investor sentiment. I often remind investors of perhaps the greatest thing ever said about market cycles, by the late-great Sir John Templeton: “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

The rub is that eras of euphoria can last for extended periods of time; like was the case leading into the March 2000 tech bubble peak. That phenomenon brings up another brilliant quip about markets courtesy of John Maynard Keynes: “Markets can remain irrational longer than you can remain solvent.”

As enticing as it may be to try to catch the next speculative wave, we instead remind investors of the power of longer-term disciplines around diversification (across and within asset classes); and especially periodic rebalancing. In the case of the latter, our recent emphasis has been to consider portfolio/volatility-based rebalancing vs. calendar-based rebalancing. In other words, investors can “stay in gear” with direct or indirect swings in market behavior and volatility in market leadership characteristics. Remember, rebalancing forces us heed the old adage of “buy low, sell high” … or in the case of periodic rebalancing, “add low, trim high.” As I’ve often said, to be a successful investor is not about what you know, but what you do.

In closing

I can’t end a report that touches on the ongoing democratization of investing without quoting our own founder, Chuck Schwab himself. His recently-published memoir Invested ended with this:

“…it was a dream that evolved into a belief that the old rules could and should be changed. Our innovations, our success, came from that sense of purpose. It’s a simple enough formula. Putting it into practice wasn’t always easy, though there is something magical and endlessly fun about banding together with people to do something no single person could ever accomplish. And the work, the innovation, is never done. There’s always another new idea, another convention to challenge, a million ways to make investing better. We just need to do it.”

Well said, Chuck.