Is the Treasury Bond Market About to Wake Up?

The bond market went into hibernation over the summer, with yields holding steady despite surging inflation, a looming battle over the federal debt ceiling, and the prospect that the Federal Reserve will begin reducing the size of its monthly bond purchases later this year. We see the potential for the market to awaken this fall, with yields moving up.

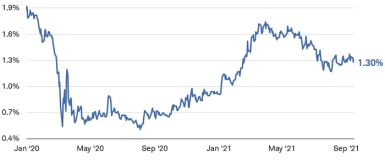

Currently, 10-year Treasury yields—which move inversely to prices—are sitting below 1.5%. It appears that investors are pricing in a return to lackluster growth and low inflation. We believe the market is too complacent and investors should be prepared for higher yields.

10-year Treasury yields are below 1.5%

Source: Bloomberg. U.S. Generic 10-year Treasury Yield (USGG10YR INDEX). Daily data as of 9/15/2021. Past performance is no guarantee of future results.

Some attribute the persistence of low yields to the Fed’s bond buying program and are anticipating a steep rise in yields as it moves toward tapering its monthly bond purchases. We are also looking for yields to move higher, but in our view, tapering isn’t likely to be the major driver since it’s already a well- known factor for the market.

Tapering: There’s risk in doing too little, too late

Federal Reserve Chair Jerome Powell and other members of the monetary-policy-setting Federal Open Market Committee (FOMC) have clearly indicated over the past few months that they plan to begin reducing the size of the Fed’s bond purchases later this year. The economy has recovered the output lost during the COVID-19 downturn, and inflation is well above the Fed’s 2% target level. Job growth hasn’t fully recovered, but enough steady progress is being made that the Fed is likely to pull back on some of the extraordinary stimulus measures it took in 2020. Consensus expectations are for the Fed to announce a plan to taper at the November meeting and begin the process soon afterward. It will likely take six to 12 months for the Fed to end its bond buying. Tapering shouldn’t surprise the market, so the impact should be limited.

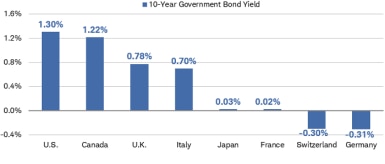

Moreover, there appears to be enough demand among banks, investment and pension funds, and foreign central banks to pick up the slack as the Fed reduces its monthly purchases from $80 billion in Treasuries and $40 billion in mortgage-backed securities. Recent Treasury auctions have been met with strong demand. Although U.S. Treasury yields are low, they are higher than government bond yields in most other major countries, making them attractive to foreign investors.

U.S. yields are above other major developed-country yields

Source: Bloomberg. Data as of 9/15/2021. Past performance is no guarantee of future results.

The bigger risk to the market from tapering may be if the Fed takes a very slow approach. Tapering sends a signal that the Fed is pulling back on extra stimulus for the economy. It suggests the economy and inflation will cool off longer-term. If the Fed withdraws the excess stimulus too slowly, it could allow inflation to rise to the point that investors begin to adjust the long-term expectations higher. If the Fed tolerates inflation for too long, it could push yields higher.

Growth and inflation may push yields higher

We see a greater likelihood that yields will rise because the economic growth and inflation will remain higher than expected.

Financial conditions, a measure of just how easy monetary policy is, are as loose as they have been in decades. This indicator bodes well for economic growth but could lead to excessive risk-taking and overheating. If the Fed tolerates too much inflation for too long, it could push yields higher.

Financial conditions remain accommodative

Note: The Bloomberg U.S. Financial Conditions Index tracks the overall level of financial stress in the U.S. money, bond, and equity markets to help assess the availability and cost of credit. A positive value indicates accommodative financial conditions, while a negative value indicates tighter financial conditions relative to pre-crisis norms. The Y axis is truncated at -2.0 for scale purposes. For reference purposes, 2020 low was -6.335.

Source: Bloomberg. Bloomberg U.S. Financial Conditions Index (BFCIUS Index), daily data as of 9/13/2021.

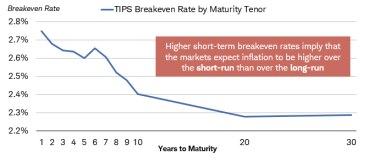

At current levels, bond yields don’t appear priced for a durable recovery or inflation holding above 2%. Market-based measures of inflation expectations indicate that investors expect the current spike to fade in the next year or two and revert to very low levels. In the Treasury Inflation Protected Securities (TIPS) market, the “breakeven rate” reflecting inflation expectations implies that inflation is expected to peak over the next year and fall back to 2.4% over the long run.

TIPS breakeven curve implies higher short-term than long-term inflation

Source: Bloomberg, as of 9/13/2021. The breakeven inflation rate is the difference between the yield of a TIPS and the yield of a nominal Treasury with a comparable maturity; it is the rate that inflation would need to average over the life of the TIPS for it to outperform a nominal Treasury.

Yet this expansion is different in many ways than those of the recent past. After the 2008 financial crisis, consumers’ balance sheets were in bad shape due to falling home prices and high levels of debt. Bank balance sheets were also very weak, limiting their ability and willingness to lend.

This time around, consumers are in good shape and fiscal policy has helped build savings. Fiscal policy has been far more expansive than in recent cycles, providing support to individuals and businesses at much higher levels. Moreover, much of the support has flowed to lower-income households, which tend to spend a higher proportion of their income, boosting demand. There appears to be plenty of savings and income to keep demand healthy. In addition, wages are rising due to a very tight labor market. While the unemployment rate is falling, job openings are still at record levels, suggesting that the shortage of labor looks likely to persist and keep wages moving higher.

With job openings on the rise, the number of unemployed likely will drop over time.

Source: Bloomberg. Job Openings (JOLTTOTL Index), Monthly, Seasonally Adjusted. Data as of 7/31/2021.

The markets are more tolerant of high government debt and inflation now, as well. Government spending has risen sharply in most major developed countries without significant political consequences. Debt-to-gross domestic product (GDP) levels have expanded sharply, while bond yields have remained low. At the same time, central banks are far less vigilant about inflation than in the past. The Federal Reserve, the European Central Bank and others have displayed little concern about the recent spike in inflation.

In our view, the market may be too complacent about these risks over the next year. Ten-year Treasury yields below 1.5% don’t provide much room for potential upside surprises in the economy or inflation. We anticipate a move up to the 1.75% to 2.0% level over the next six to 12 months.

We continue to suggest investors keep the average duration in their portfolios low. Duration estimates how much a bond’s price will change when interest rates change. The higher the duration, the more a bond’s price will decline. Because we expect yields on intermediate- to long-term bonds to rise further, we favor keeping the average duration on the low side until yields move higher. Bond ladders can be a useful strategy to help you average into higher yields over time.