Diversification: Finally Back After 20 Years

Key Points

The trend in the degree to which the world's stock markets move in sync with each other has fallen to the lowest level in 20 years.

The lower correlation enhances the potential risk-reducing benefits of diversification.

This may be especially good news right now since stocks may be due for a pullback.

Las acciones tienen un comienzo sólido este año, pero el alza no es generalizada. Los mercados alcistas se pueden encontrar en las acciones de países de todo el mundo, pero sus movimientos están menos correlacionados entre sí de lo que han estado en los últimos 20 años. El cambio trae el retorno de un importante beneficio de diversificación para los titulares de carteras diversificadas a nivel global.

Zig y zag

Tradicionalmente, la lógica detrás de las acciones internacionales en una cartera no era solo por sus posibles retornos, sino también por el beneficio de la diversificación que reduce los riesgos. El razonamiento es que, si un mercado cae, otro se levanta, lo que da como resultado un camino más fluido hacia los objetivos financieros.

Lamentablemente, durante gran parte de la década del 2000, la diversificación global se había desvanecido a medida que las acciones de todo el mundo se movieron cada vez más en sincronía entre sí. En nuestra opinión, hubo un par de razones clave para esto.

- Las acciones globales se vieron afectadas en conjunto por la tecnología centrada en los EE. UU. y las burbujas inmobiliarias.

- La economía global cada vez más integrada impulsó las ventas internacionales a fin de superar las ventas nacionales para las empresas globales en el índice MSCI All Country World Index.

- Estos factores contribuyeron a las correlaciones más altas entre los mercados de valores: cuando un mercado caía, los otros también caían.

¿Volver a la normalidad?

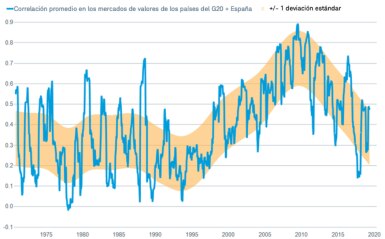

Afortunadamente para los inversionistas, ha vuelto la diversificación. En términos estadísticos, la tendencia en correlación entre los mercados de valores del Grupo de 20 países (más España, que es un cuasimiembro), que juntos conforman el 80 % del PIB mundial, alcanzó su pico en el 2011 y desde entonces ha caído a niveles no observados en 20 años, como se puede ver en el gráfico a continuación.

Tendencia de la correlación del mercado de valores global cae a mínimos de 20 años

Correlación diaria, corrida anual de un cambio porcentual mensual en los índices MSCI de lo países del G20 y España.

Fuente: Charles Schwab, Macrobond, datos del MSCI a partir del 12/4/2019

Esta disminución en la correlación ha tenido lugar a pesar del amplio crecimiento económico de estas economías y de la operación entre ellas. En el gráfico anterior, casi parece ser un retorno a “la normalidad” para la correlación, ya que la tendencia ilustrada por la desviación estándar ha regresado al nivel promedio que prevaleció durante más de 25 años en la década de 1970, 1980 y en gran parte de la década de 1990 antes de las burbujas tecnológicas e inmobiliarias.

Posible desaceleración

Si se mantiene esta correlación más baja, y los beneficios de la diversificación que reducen el riesgo que indica a medida que los mercados se mueven más independientemente unos de otros, es una noticia particularmente buena en este momento. Las acciones pueden estar listas para una desaceleración debido a los recientes signos de advertencia, como la inversión de la curva de rendimiento.

¿Persistirá el declive de la correlación con el nivel más bajo en 20 años o podrían los mercados de valores globales deslizarse todos juntos? Solo tenemos que volver al año pasado para comprobar que las correlaciones pueden permanecer relativamente bajas. Los mercados de valores de todo el mundo sufrieron diversos grados de pérdidas el año pasado, lo que incluye una marcada caída del mercado bajista a fines del año. Sin embargo, las correlaciones subieron solo a la parte superior del rango de la pendiente descendente, en lugar de volver a los niveles máximos de 2011. Esto ofrece cierta confianza de que, incluso durante los mercados bajistas, las correlaciones pueden permanecer más bajas que en la década del 2000.

El impulsor de las correlaciones más bajas entre los países parece ser una correlación más baja entre los sectores que impulsan los mercados de valores de los diferentes países. Por ejemplo, las acciones de energía han tenido un recorrido desenfrenado en los últimos años, mientras que las acciones de tecnología han aumentado de forma paulatina. Las acciones financieras han sido volátiles y han quedado sujetas a los movimientos en la curva de rendimiento. Siempre que estos impulsores divergentes eviten que las correlaciones del sector aumenten, las correlaciones del país también deberían permanecer relativamente bajas.

Riesgo principal

Desde nuestro punto de vista, el principal riesgo para la tendencia de correlaciones menores es un evento global que haga que todos los sectores y mercados de valores de los países se muevan a la baja juntos. Ahora, el sistema económico, financiero y de mercado global parece estar mejor preparado para gestionar los impactos del pasado, como el “naufragio tecnológico” del 2000-2002 y la crisis financiera global del 2008-2009, si se repitieran en el futuro. Pero hay otras mayores vulnerabilidades que podrían causar que una sacudida se convierta en otra crisis y dar como resultado el retorno a correlaciones altas, entre ellas:

- Altos niveles de deuda

- Fragmentación política

- Dependencia de las ventas internacionales

- Municiones de políticas fiscales o monetarias insuficientes

- El aumento de inversiones pasivas

Para perspectiva sobre todos estos aspectos, consulte nuestro artículo reciente: ¿De dónde vendrá la próxima crisis? Si bien son plausibles, estas vulnerabilidades que se convierten en una crisis no forman parte de nuestro caso base, al menos para los próximos uno o dos años.

Gran beneficio

El retorno a la correlación promedio más baja entre los mercados de valores en 20 años tiene el potencial de ofrecer a los inversionistas diversificados globalmente el beneficio de menos volatilidad sin obstaculizar los rendimientos en el camino hacia los objetivos financieros, en esencia disminuyendo el riesgo sin disminuir la rentabilidad.