Bond Market Blues: High Inflation and Low Yields

Coming into the fourth quarter, we were expecting a rise in yields and volatility. Bond yields appeared to be too low in the face of rising inflation and investors too complacent about the potential for tighter monetary policy. It didn’t take long for things to change. Treasury yields have risen across the curve since the end of September. Ten-year Treasury yields have jumped by 34 basis points and two-year yields are up 12 basis points since mid-September as the market pulls forward expectations for the Federal Reserve to hike rates.1 For bond investors, a difficult investing environment has just gotten more difficult.

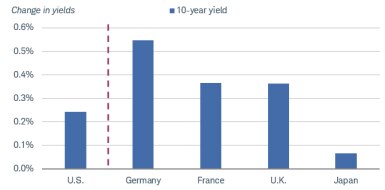

Many countries have seen their yields rise more than U.S. yields over the last two months

Source: Bloomberg. Ten-year bond yields, U.S. (USGG10YR), Germany (GTDEM10YR), U.K (GTGBP10YR), and Japan (GTJPY10YR). The change from 8/12/2021 and 10/12/2021. Past performance is no guarantee of future results.

Inflation: How long will the Fed wait to respond?

With inflation likely to remain above the Fed’s target of about 2.0% for some time due to supply-side constraints, we believe the Fed’s policy response will be the big factor driving yields in the months ahead. For developed-market economies, the long-run inflation rate is largely driven by the central banks’ policy choices. Over the past 40 years, central bankers earned a reputation for responding quickly to signs of inflation. As a result, inflation and inflation expectations were subdued for years.

Recently, however, the Federal Reserve shifted its approach, adopting “average inflation targeting.” After years of inflation undershooting its 2% target rate, the Fed intends to allow it to overshoot for a “period of time” in hopes of boosting employment growth. The policy shift was announced in August 2020 and didn’t generate much market reaction at the time since inflation was running below 1% and the unemployment rate was above 8%.

Inflation remains elevated

Source: Bureau of Labor Statistics. Civilian Unemployment Rate (U3 Rate), Percent, Monthly, Seasonally Adjusted. Shaded area indicates recession. U.S. Consumer Price Index (CPI YOY Index). Monthly data as of 9/30/2021.

Now that conditions have changed, the Fed’s response will likely determine how high yields go from here. To date, most Fed officials have maintained the view that inflation pressures are “transitory” and that there is no rush to tighten policy. The focus is on reaching full employment before addressing its inflation mandate. However, there have been some members expressing concerns that inflation will linger longer than previously anticipated, and the Fed is moving forward with tapering its bond purchases later this year. Tapering isn’t tightening, but it’s the first step along the road. Moreover, about half the members of the FOMC have indicated a preference for beginning to raise short-term rates next year.

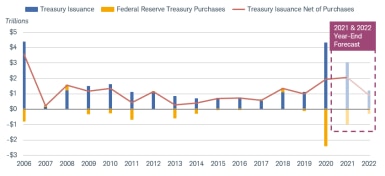

We aren’t that concerned about tapering’s impact on yields, because Treasury issuance is expected to decline, as well. Based on our estimates for the Fed to taper $10 billion in Treasuries and $5 billion in mortgage-backed securities, combined with budget estimates from the Congressional Budget Office, it looks like the decline in Fed purchases will be more than offset by a drop in new issuance of Treasuries over the next year.

Treasury issuance forecast

Note: The forecast used the Congressional Budget Office's forecast for the U.S. deficit and assumes The Federal Reserve tapers by $10B/month for Treasuries from November 2021 to May 2022, then reinvests income for the remainder of 2022.

Source: Bloomberg & The Congressional Budget Office. The Federal Reserve Balance Wednesday Close Treasury Securities and Total U.S. Marketable Debt Outstanding (FARWUST Index, DEBPMARK Index) as of September 2021. The Congressional Budget Office's Debt Projections as of July 2021.

However, we are concerned that the Fed may be underestimating the potential for inflation to persist at above-target levels. High prices from supply chain issues are taking longer than expected to resolve, while demand could remain firm as wages rise amid a tight labor market and still-expansive fiscal policy. Moreover, some of the longer-term factors that have contributed to keeping inflation low—such as the expansion of the global workforce and trade —may be abating.

Currently, the implied inflation expectation over five years is 2.6%, moderately above the Fed’s target. The Fed may take some comfort that expectations are still “anchored.” However, even if that outlook for inflation proves accurate, it would still leave real yields—adjusted for inflation—in negative territory.

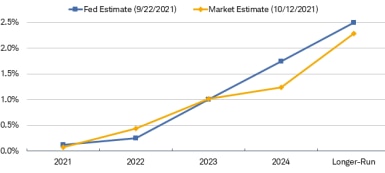

The market is now pricing in two rates hikes of 25 basis points each in the federal funds rate in 2022—a more aggressive pace than implied by the Fed’s recent projections, which indicate at most one hike in 2022. If the Fed lags behind those expectations, it may raise concerns that the central bank will have a hard time catching up.

The Fed versus the Market

Source: Bloomberg. The market estimate of the Fed funds using Eurodollar futures (EDSF). As of 10/12/2021.

Note: the 12/15/2027 Eurodollar futures rate was used for the longer-run market rate.

Potential changes at the Fed

A final complicating factor is that there are likely to be many personnel changes at the Fed in the next year. Terms for Fed Chair Jerome Powell and Vice Chair Richard Clarida are both expiring in 2022. There has been no clear indication from the administration that Powell will be re-nominated or who might replace him. The vice chair for regulation position is turning over with no successor appointed, and there are open seats on the Board of Governors. Recent resignations of two regional Fed Bank presidents—Robert Kaplan of Dallas and Eric Rosengren of Boston—add to the mix. Kaplan was due to be a voting member in 2022. The myriad potential changes raises the potential for a shift in policy.

What’s an investor to do?

We continue to suggest keeping average duration low due to our expectation for yields to push higher. We see the potential for 10-year Treasury yields to move up to 1.75% this year and above 2% in the first half of next year. Our outlook for credit is positive given the healthy economic backdrop, but corporate and municipal bond spreads are low, limiting total return potential.

Over the next six to 12 months, we suggest investors look for opportunities to extend duration if yields move higher, as anticipated. The early stages of rising yield cycles are usually characterized by rising longer-term rates and steepening yield curves. However, once the prospect of tighter policy is on the horizon, long-term yields have tended to peak well before the initial rate hike of the cycle. In the past three rate-hike cycles, 10-year yields peaked six to 12 months before the Fed began raising short-term rates and tightening policy.

Change in 10-year Treasury relative to first rate hike

Source: Bloomberg. U.S. Generic 10-year Treasury Yield (USGG10YR INDEX), using weekly data for the specified time periods. Past performance is no guarantee of future results.

Instead of trying to time the market cycle, we would use a strategy, like a ladder, of averaging into higher yields over time. Over the long run, we don’t see rising bond yields as a reason for bond investors to be blue. Higher yields—in real terms—are good for income investors.

1One basis point is equivalent to 0.01% (1/100th of a percent) or 0.0001 in decimal form, so 34 basis points is equivalent to 0.34% and 12 basis points is equivalent to 0.12%.