2022 U.S. Market Outlook: Under Pressure

Bear with us as (no pun intended) you read this longer-than-usual outlook!

The 2020 COVID recession was sharp, but short at only two months; while the rebound in activity has also been sharp, but uneven across economic metrics. Overall gross domestic product (GDP) moved from the recovery phase to the expansion phase as of the second quarter of 2021. As highlighted in the visual below, the question heading into 2022 is where we go from here—especially due to the stark reminder on this year’s “Bleak Friday” that the pandemic is nowhere near behind us.

Oh c’mon omicron!

How many times over the past 18 months have we started to breathe signs of relief that the pandemic was rounding the corner to becoming endemic, only to be hit by second or third waves, the delta variant and now the omicron variant?

Based on initial World Health Organization (WHO) findings, the omicron variant spreads more quickly, can cause more serious cases, and/or may decrease the effectiveness of vaccines and treatments. What we’ve learned from the delta variant is that it’s difficult to arrest the spread. What the entire world has learned throughout the pandemic, however, is that it’s the restrictions and/or lockdowns imposed that cause the most economic damage; while countries have vastly different reaction functions.

The rub at this stage in the global recovery is that the economic, supply chain, and inflation backdrop is significantly changed relative to prior waves/variants. The pandemic has exposed instability in complex global supply chains; possibly ushering in a coming secular environment of pervasive supply shocks, vs. the demand shocks that were more commonplace for much of the past two decades. Expect more talk about companies switching from just-in-time inventory management to just-in-case. We all have to wait to see if the effects of omicron are significant; and whether they do more damage to demand, or exacerbate supply chain problems.

What say you LEI?

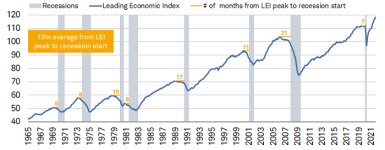

Without yet possessing more detailed analysis of the threat of omicron, we’re left with more traditional ways to judge the economic landscape for the coming year. As shown below, the Leading Economic Index (LEI), shows that the U.S. economy remains strong and well above the pre-pandemic high. The average span between LEI highs historically, and recession (gray bars) starts has been 12 months. While there is no sign of an imminent peak, a more serious economic threat wrought by omicron, or any number of other threats, could put a dent in leading indicators.

LEI Not Yet Looking Back

Source: Charles Schwab, Bloomberg, The Conference Board, as of 10/31/2021.

Consumers’ strength being tested

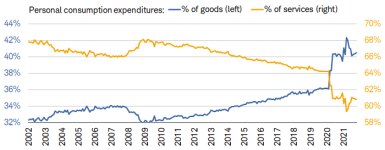

Consumer spending drives 70% of overall U.S. real GDP; with the metric of retail sales a proxy for consumption. As shown below, thanks to copious fiscal and monetary stimulus, consumer spending has been on fire; but with significantly different trajectories for goods and services consumption. The wholesale economic lockdown imposed in the spring/summer of 2020 led to an unprecedented divergence; while 2021’s reopening phase led to the start of a convergence. Virus trends hold a key to whether the convergence gets arrested.

Goods/Services Divergence/Convergence

Source: Charles Schwab, Bloomberg, as of 10/31/2021.

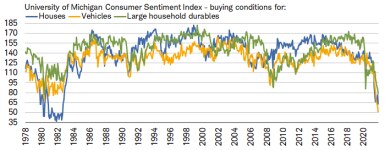

One thing is for sure is that the future for certain pockets of goods consumption looks a bit bleak given elevated inflation. As shown below, buying intentions for large-ticket items, including vehicles, houses and household durables have imploded.

Implosion in Buying Intentions

Source: Charles Schwab, Bloomberg, as of 11/30/2021.

The virus, and this year’s inflation surge, have also put a big dent in broader measures of consumer confidence. There is one consumer-based spread that bears watching heading into 2022, as it could represent the first heads-up for a possible recession. Consumers’ confidence about their present situation has weakened, but there’s been an even greater deterioration in their expectations for the future; resulting in a historically wide spread between the two, as shown below (a consistent recession warning in the past).

Consumers Less Optimistic About Future

Source: Charles Schwab, Bloomberg, as of 11/30/2021.

Labor market: headline strength, with confirmations still lingering

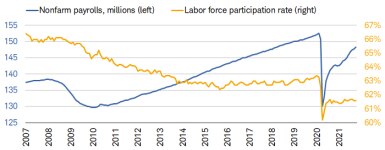

Key to the 2022 outlook for the consumer, but also the broader economy and inflation, is the labor market. As shown below, total nonfarm payrolls have made a remarkable recovery since the trough in April 2020; but remain 4.2 million below the pre-pandemic peak. At the same time, the breadth of gains is lessened given the still-anemic labor force participation rate, which (as shown below) has moved sideways since August 2020 and is well below its pre-pandemic peak. While we think that the participation rate has room to increase in 2022—boosted by stronger business capital spending and a broadening out in job creation—the climb will likely be slow.

Strong Payroll Recovery Not Matched by Strong Participation

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics (BLS), as of 10/31/2021.

Participation vs. resignation

A slower improvement in participation is due to the unfortunate reality that, per the U.S. Census Bureau, 2.5 million individuals are still hesitant to re-enter the workforce because of the virus. Another large slate—estimated by the St. Louis Federal Reserve to be nearly 3 million—has retired early. Finally, a third cohort is reassessing their work/life balance.

In the face of the omicron variant news, it’s clear that the virus will continue to be a factor in the trajectory of labor force participation. A major side effects of the pandemic continues to be workers’ desires and newfound chances to change jobs. With that has come a delay in workforce re-entry and a subsequent strain on businesses’ abilities to fill roles. This, along with early retirements, has culminated in what has been dubbed the “Great Resignation.”

As shown below, job openings remain much higher than any pre-pandemic rate; while the quits rate recently hit a record 3%, signaling workers’ confidence in finding better/higher-paying jobs. While we think both job openings and quits will remain elevated in 2022, current levels are likely unsustainable—especially if some pressure is eased by virtue of a rising labor force participation rate and net job creation.

Power Back to the Worker

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics, as of 9/30/2021.

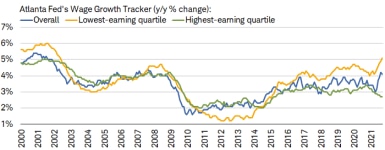

The main benefit of elevated job openings and quits has been rising wages. As shown below, the median wage is increasing at annual rate of more than 4% per the Atlanta Fed’s wage tracker; with the lower end of the income spectrum experiencing the fastest wage gains. While we expect wage gains to remain firm, the best days for low earners may be nearing, especially as they continue to find jobs, effectively closing the gap, and as productivity (hopefully) improves.

Wage Growth Wakes Up

Source: Charles Schwab, Bloomberg, as of 10/31/2021. Atlanta Fed's Wage Growth Tracker is a measure of the nominal wage growth of individuals.

Inflation: putting the genie back in the bottle(neck)

Strong wage growth is a key input for the hot inflation environment; and rampant uneasiness is justified, given the Consumer Price Index (CPI) is well above the five-year average of its annual change. That is the widest spread since 1980, as shown below.

Inflation’s Sting

Source: Charles Schwab, Bloomberg, as of 10/31/2021.

Tying inflation to aforementioned trends in consumption, as shown below, core (ex-food/energy) goods inflation has by far been the primary driver of headline core inflation. That makes sense for several reasons:

- The world was effectively forced to shift spending to goods at the expense of services when the pandemic hit.

- Even as restrictions eased this year, goods demand didn’t fade markedly given the services sector faced rolling restrictions.

- Factory shutdowns in Asia (due to the spread of the delta variant) roiled supply chains, pushing goods prices up at an even faster rate.

Inflation Remains Narrow for Now

Source: Charles Schwab, Bloomberg, as of 10/31/2021.

For those reasons, there has not yet been an equivalent surge in core services inflation, which contrasts with the hyperinflation of the 1970s and early-1980s. We believe services inflation has room to rise in 2022, but it could very well be curtailed by the omicron variant; while several forces could put downward pressure on goods prices:

- Reverse base effects: year-over-year changes in the first half of 2022 will be against 2021’s surge in prices, which could bring down CPI growth rates, especially if auto and hotel prices (culprits in 2021’s inflation surge) continue to drop.

- Supply side relief: freight shipping costs have rolled over, the number of containers sitting on docks has dropped, and factory production around the world is improving.

- Boomerang effect: companies’ double-buying efforts to satisfy recent demand is resulting in a swift inventory rebuild, which could bring about an eventual supply glut and attendant cooling in prices.

Mind the generation gap

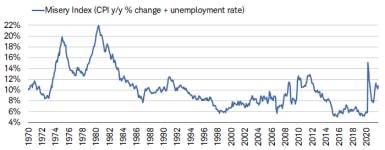

There are rampant fears of stagflation akin to the 1970s-1980s, but the good news for now is that unemployment is not on the rise. As shown below, the toxic mix of high inflation and a surge in the unemployment rate brought the economy to its knees starting in the 1970s. The combined rate—known as the Misery Index—climbed above 20% at the height of the 1970s’ crisis, more than double the current rate.

Rise in CPI Pushing Up Misery Index

Source: Charles Schwab, Bloomberg, as of 10/31/2021.

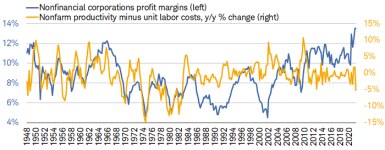

A major driver of 1970s’ stagflation was persistently soaring unit labor costs, which weighed on companies’ productivity and profit margins. As shown below, the spread between productivity and labor costs moved in lockstep with profit margins back then; but for now, margins are bucking the latest decline in productivity.

Profit Margins Not Yet Dented by Higher Labor Costs

Source: Charles Schwab, Bureau of Economic Analysis (BEA), Bloomberg, as of 9/30/2021.

Some of that is attributable to globalization and the long-term decline in effective corporate tax rates, with which margins have become inversely correlated over the past couple decades. Yet, in the last year, the main driver of stronger margins was companies’ slashing of both labor and capital during the depths of the pandemic. The faster-than-expected recovery in both demand and pricing power resulted in a goldilocks environment for fundamentals, thus delivering a solid foundation for stock market returns.

We don’t expect productivity to continue its recent weakening trend relative to unit labor costs; but we also don’t think profit margins’ current levels will persist in 2022. That should result in a relatively benign convergence for both series in the chart above. Key to watch will be whether we transition into a “counter-cyclical” inflationary environment, in which companies’ pricing power would fade alongside consumer demand. We do know that the pandemic boosted productivity in certain economic segments, but also unleased a labor market mismatch; while massive stimulus arguably kept many “zombie” companies afloat.

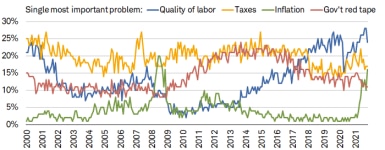

Also important to keep an eye on is whether inflation continues to affect business confidence. As shown below, inflation has been a relatively dormant issue for the past decade, but companies are now facing strains from higher prices and the inability to find skilled workers. An easing in supply chain pressures should help to alleviate costs, especially for small businesses.

Inflation’s Surging Impact on Small Business Confidence

Source: Charles Schwab, Bloomberg, National Federation of Independent Business (NFIB), as of 10/31/2021.

Throughout history, CPI increases of recent magnitudes were typically accompanied by weakness in the stock market. In the pandemic era, asset inflation preceded real economy inflation, with an attendant record-breaking surge in household net worth. The weight of the stock market in terms of the economy, as well as its influence on confidence, cannot be overstated. The next significant drop in asset prices could deliver an outsized hit to economic growth, as was the case in 2001. That year’s recession was a direct result of the bursting of the tech stock bubble in 2000.

Tapering to pick up speed?

Top of mind heading into 2022 is whether the Federal Reserve will speed up the pace of tapering. The Fed announced a pace of reduction of balance sheet additions of $15 billion per month ($10 billion of Treasuries and $5 billion of mortgage-backed securities), but only for November and December. The emergence of the omicron variant put downward pressure on yields, and a knee-jerk assumption of less tightening to come, with an expected three hikes by the end of 2022 shifting to only two.

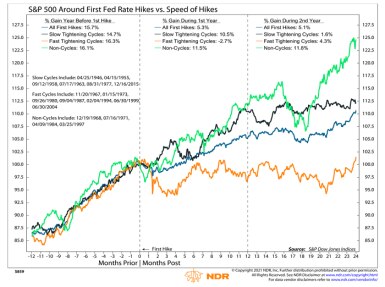

For now, the Fed plans to complete tapering before it begins hiking rates. Assuming no significant hit to economic activity from omicron, or a retreat in inflation pressures, we do expect the Fed to up the pace of tapering heading into 2022. Based on history, it’s not the timing of the first rate hike that matters, it’s the trajectory and speed once rate hikes begin.

As shown below, in terms of the first year of Fed tightening cycles (middle field) stocks historically performed best under “non cycles” of rate hikes—when no more than two hikes were instituted, before the Fed halted. Stocks also had little trouble digesting “slow” rate hike cycles—when the Fed took a break by waiting at least one FOMC meeting in between each hike. Worst case for the market was during “fast” rate hike cycles—when the Fed hiked rates at most FOMC meetings. As shown in the left field, stocks typically did well in the year leading up to the initial rate hike.

Source: ©Copyright 2021 Ned David Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/. Data is indexed to 100 at date of first Fed rate hike. Past performance is no guarantee of future results.

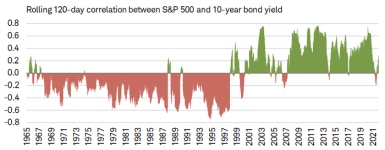

A relationship that bears watching, and may help lay to rest the debate about whether inflation will turn out to be ultimately transitory, is between bond yields and stock prices. As shown below, for three decades starting in the late-1960s, they were mostly negatively correlated. That was an era punctuated by greater frequency of supply shocks, and an over-arching inflationary backdrop. For the two decades that followed, bond yields and stock prices were mostly positively correlated. This has been an era punctuated by a few demand shocks, but very few supply shocks; and an over-arching disinflationary backdrop.

Long Cycles of Bond Yield/Stock Price Correlations

Source: Charles Schwab, Bloomberg, as of 11/26/2021. Correlation is a statistical measure of how two investments have historically moved in relation to each other, and ranges from -1 to +1. A correlation of 1 indicates a perfect positive correlation, while a correlation of -1 indicates a perfect negative correlation. A correlation of zero means the assets are not correlated. Past performance is no guarantee of future results.

After a brief dip into negative territory in mid-2021, the correlation is back in positive territory again. Any sustainable move back into negative territory could signal an inflation regime shift akin to what developed in the late-1960s; which ultimately led to significant policy errors in the 1970s.

A policy error remains a risk for 2022; especially if stock market participants’ optimism continues to be boosted by the (perhaps-erroneous) assumption that the Fed will always have the market’s back. This may be particularly relevant for the younger cohort of investors who have been “educated” about the stock market only during the pandemic era.

Alerting to risks means we don’t get it?

I was recently a guest on Scott Galloway’s very popular Prof G Podcast, and we chatted a bit on the younger cohort of retail traders. Scott has rightly been reinforcing that “for their entire life, the market has gone up [and] if you say otherwise, you just don’t get it.” Scott also noted something I experience quite frequently on Twitter: “There is a surrender-to-the-narrative-or-else attitude online, and it’s really frightening, because if you say Bitcoin is overvalued, or Tesla is overvalued, or whatever popular SPAC is overvalued, these trolls in anonymous accounts come out of the woodwork and start attacking you.”

Narratives—even those bordering on the absurd—can push markets higher than fundamentals justify. At Schwab, we try to live in a world of fundamentals, data, investor sentiment and history; and spend less time focusing on pure narratives. Heading into 2022, what history says about valuations, earnings and sentiment is mixed-to-concerning.

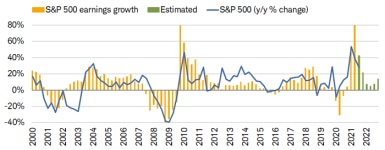

Earnings’ fire becoming less hot in 2022

S&P 500 earnings have been on fire since mid-2020; with a sharp v-recovery into the second quarter peak. Earnings growth, although still strong in an absolute sense, is expected to descend through at least the first half of next year. As shown below, there is a close historical relationship between the growth rate in S&P 500 earnings and the year-over-year change in the index itself. This in and of itself isn’t a warning of impending doom; but is perhaps a message to curb your enthusiasm about future equity market returns remaining as robust as the pace of the past 20 months.

Earnings Growth Rate Tied to S&P 500 Returns

Source: Charles Schwab, I/B/E/S data from Refinitiv, as of 11/26/2021. 4Q08's reading of -67% is truncated at -40%, 4Q09's reading of 206% is truncated at 80%, and 2Q21's reading of 96% is truncated at 80%.

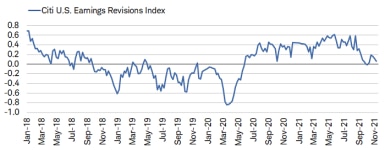

In addition, upward earnings revisions (by Wall Street’s analysts) have taken a turn for the worst, as shown below. This supports our view that companies bucking the broader trend and enjoying higher earnings revisions will continue to perform well relative to the overall market in 2022. It is in keeping with our view that the “quality trade” will persist as a general leader; with the low-quality/highly-speculative trades that dominated the start to 2021 remaining in the rear-view mirror.

Earnings Revisions Under Pressure

Source: Charles Schwab, Bloomberg, as of 11/12/2021. Revisions index measures the number of equity analyst revisions upgrades (positive) and downgrades (negative).

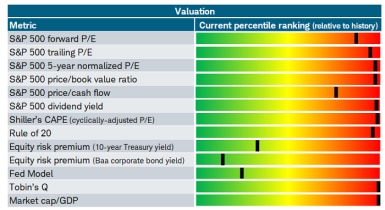

Stocks expensive, unless using “yields lens”

Earnings are a component of many popular valuation metrics. The “heatmap” below shows that most valuation metrics are well into the red (expensive) zone as we head into 2022; with the notable exception of those which measure valuation in the context of low bond yields. (Another take on this, however, is that bonds are expensive, which makes stocks look “artificially” cheap.)

Source: Charles Schwab, Bloomberg, The Leuthold Group, as of 10/31/2021. Due to data limitations, start dates for each metric vary and are as follows: CAPE: 1900; Dividend yield: 1928; Normalized P/E: 1946; Market cap/GDP, Tobin’s Q: 1952; Trailing P/E: 1960; Fed Model: 1965; Equity risk premium, forward P/E, price/book, price/cash flow, rule of 20: 1990. Percentile ranking is shown from lowest in green to highest in red. A higher percentage indicates a higher rank/valuation relative to history.

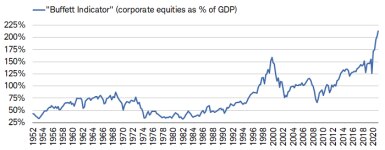

Honing in on the last row of the heatmap above, market cap/GDP is often referred to as the “Buffett Indicator” given it’s Warren Buffett’s oft-expressed favorite valuation metric. As shown below, never before in the post-WWII era have stocks been as richly valued relative to the size of the economy. This relates back to our concern that the next serious correction or bear market in stocks could have an outsized impact on both confidence and the economy.

Buffett Indicator in Stratosphere

Source: Charles Schwab, Bloomberg, as of 6/30/2021.

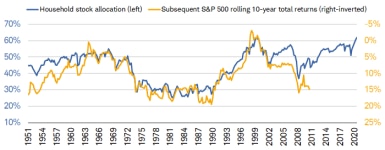

Adding salt to that potential wound is the fact that U.S. households currently have more than 60% exposure to equities—about even with the prior peak in 2000, as shown below. It shouldn’t come as a surprise that the higher the equity allocation historically, the lower the subsequent long-term return. This doesn’t necessarily suggest impending doom for equities next year; but it’s a cautionary tale longer-term.

Households’ Exposure to Equities in Rarified Air

Source: Charles Schwab, Bloomberg, ©Copyright 2021 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/, 12/31/1951-6/30/2021. Equity allocation (includes mutual funds and pension funds) is % of total equites, bonds and cash. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Euphoria is not an investing strategy

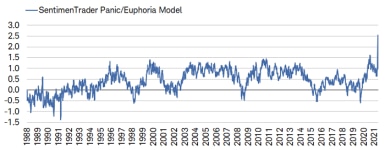

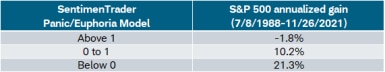

Just as panic is not an investing strategy, nor is euphoria or FOMO (fear of missing out). SentimenTrader’s Panic/Euphoria Model below shows a recent parabolic increase in euphoria relative to panic. When excessive optimism, heightened complacency, and/or speculative froth is accompanied by healthy market breadth, it’s less of a concern. Given weaker recent breadth trends, the combination bears close watching in 2022.

Euphoria’s Unprecedented Surge

Source: Charles Schwab, SentimenTrader, as of 11/29/2021. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance does not guarantee future results.

Buying and speculation has increasingly been leveraged by increasing levels of margin debt. Heading into 2022, the ratio of cash at brokers is at a record low relative to record high margin debt, as shown below. Given that margin is being used by a broader cohort of investors, it means that margin calls may come more frequently and after smaller downside moves in stocks; a risk to consider as we head into 2022.

Record High Margin, Record Low Cash Balances

Source: Charles Schwab, Bloomberg, ©Copyright 2021 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/, as of 10/31/2021.

What to do

I don’t manage portfolios, but I have much sympathy with what two investing legends have recently said. Leon Cooperman has been very vocal about being “a fully invested bear;” and Julian Robertson believes that “trying to sell short in this market is like being run over by a train that’s going to derail a mile down the road.”

The environment that persisted in 2021 could persist in 2022. As shown below, for all the talk of a “resilient market,” under the surface, the churn in terms of drawdowns was significant. Rotational corrections are preferred over the bottom falling out all at once; but there is a risk that indexes, at some point, reflect more of the weakness that has persisted under the surface.

Source: Charles Schwab, Bloomberg, as of 11/26/2021. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Macro backdrops that include slower growth, and a move from a loose to tighter monetary policy, tend to usher in higher intra-market correlations and greater tail risks. We continue to recommend a bias toward quality and not trying to time short-term sector rotations. For stock pickers, we believe factor-based investing makes more sense than simple sector-based (or traditional growth/value index-based) investing. In keeping with that, heading into 2022 we have nine out of 11 S&P sectors rated “neutral” with only one “outperform” (Healthcare, representing the best “quality” proxy) and only one “underperform” (Utilities, which represent an overvalued sector even though they still reside in value indexes).

Readers are keenly aware of concerns we have about the investing landscape in 2022. But what should not (never) be inferred is that we suggest investors should be “getting out.” One of my oft-expressed mantras about investing is that neither “get in” nor “get out” is an investing strategy—that simply represents gambling on moments in time, while investing should always be a disciplined process over time.

That discipline should involve diversification—across and within asset classes—and periodic rebalancing. Investors need to remain extremely alert to the risks of monetary policy, inflation, speculative froth, and ongoing virus concerns. But what ultimately matters is not what we know about the future; it’s what we do along the way.